Why the FSC decided to introduce the issuance of Security Tokens into the Capital...

The reason is to correct the turbid cryptocurrency market and protect investors. This means that they will receive the securities declaration form and investment...

[Part 2] 13 Questions and 13 Answers about virtual asset tax in Korea

7. Local income tax 10%

But actually, the 20% tax isn't everything.

Taxation at 20% does not take into account the 10% local income tax.

What is...

[Part 1] 13 Questions and 13 Answers about virtual asset tax in Korea

1. Virtual Asset

Coins like Bitcoin or Ethereum are largely divided into two terms.

First, when it is called as currency like virtual currency or cryptocurrency.

Second,...

(Part 4) Crypto of Korea: Exchanges

The ‘F’ Word

Nightclubs often utilize an interesting business model. Many of the nightclubs in South Korea, for example, rely on VIP table renters and...

(Part 3) Crypto of Korea: Exchanges

Not the kind of global coverage you want

The BCH issue happened in late 2017 during the peak FOMO period for cryptocurrency trading in the...

(Part 2) Crypto of Korea: Exchanges

BCH

In light of those high points, one of them stands out to Koreans perhaps more than the others. Although incredulous newcomers to the cryptocurrency...

(Part 1) Crypto of Korea: Exchanges

2018 started off with Bitcoin being just over a week removed from its highest price-point ($19.6k) and market cap ($335.5 billion) ever up until...

Korean investors are tired of crypto regulation

PayPal, the world's largest online payment company with about 350 million users, has come to support cryptocurrencies such as Bitcoin.

Thanks to this news, the...

(Part 1) What if a CBDC was issued in Korea?

If the use of CBDC spreads, bank deposits are likely to decline. E-money payments are more convenient than cash, and in Korea, there is...

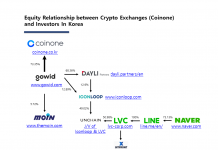

Equity Relationship 3) Between the Crypto Exchange(Coinone) and Investors in Korea

Download Equity Relationship3_200725

![[Part 2] 13 Questions and 13 Answers about virtual asset tax in Korea](https://coinhubkorea.com/wp-content/uploads/2021/04/bitcoin-tax-south-korea-218x150.jpg)