Stablecoins are one answer to the price instability of crypto-currencies. Whilst of course being much more than just this, stablecoins offer an on-boarding ramp for many who are worried about the drastic price instability of crypto-currencies. Stable is a relative term, to be stable you need to have something to compare against. As a result many different stablecoins have emerged, using fiat currencies or gold and resource prices as metrics to test stability.

Stablecoins are one answer to the price instability of crypto-currencies. Whilst of course being much more than just this, stablecoins offer an on-boarding ramp for many who are worried about the drastic price instability of crypto-currencies. Stable is a relative term, to be stable you need to have something to compare against. As a result many different stablecoins have emerged, using fiat currencies or gold and resource prices as metrics to test stability.

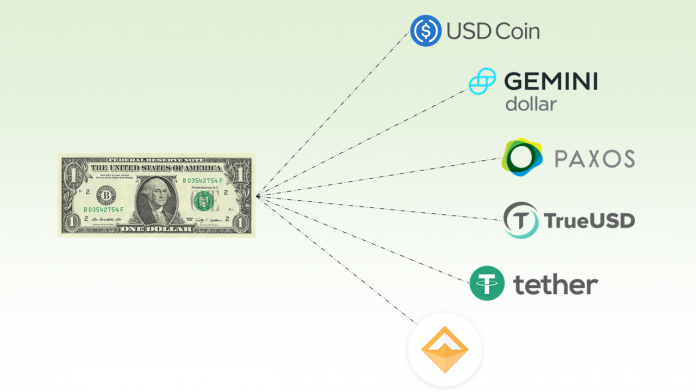

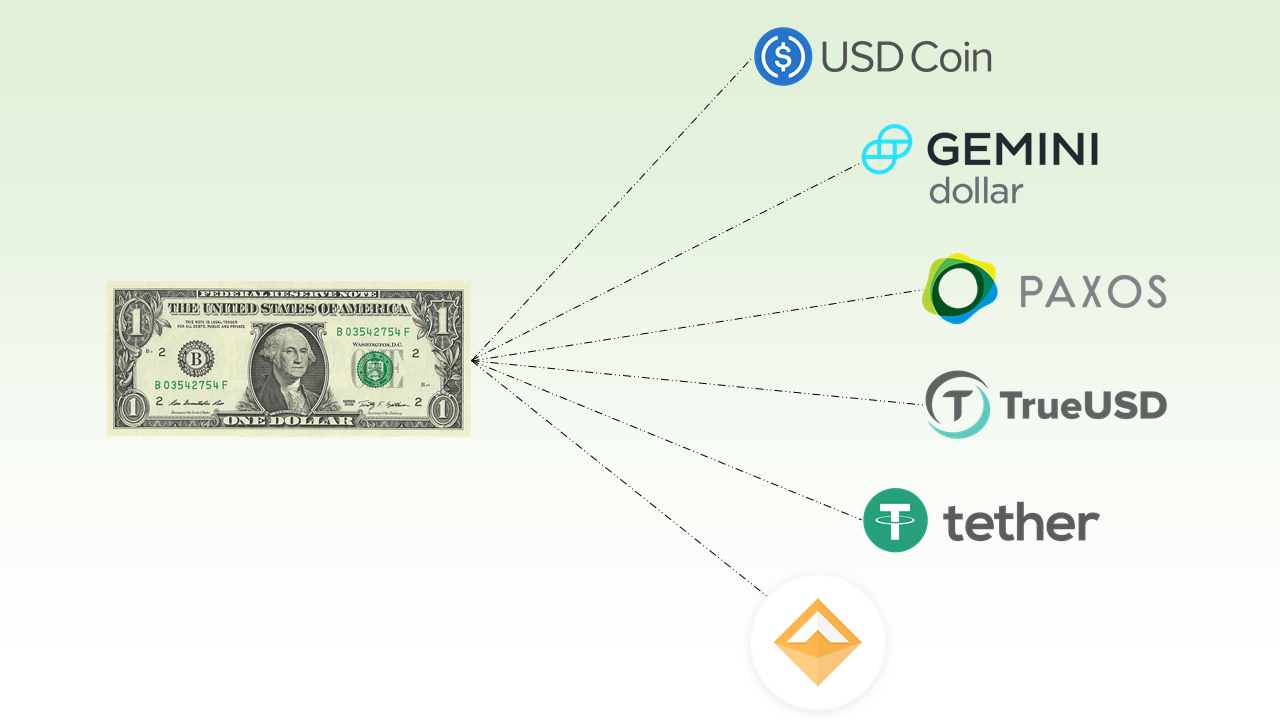

Fiat-Collateralised

Fiat-collateralised stablecoins are those which are backed by fiat currencies. These can be USD, RMB, or any other state-backed currencies, although similar projects have emerged, instead using Gold. These stablecoins are backed by fiat assets that the issuing company holds in a separate account, normally this will be a bank or vault with X amount to back the value of its crypto.

Crypto-Collateralised

Our article topic, DAI, is an example of a crypto-collateralised stablecoin. These crypto-collateralised stablecoins are backed by a collection of other decentralised assets. A problem some have with these are that as they are backed by other cryptos, which means they can be seen as risky due to the current volatility and uncertainty of crypto prices. However, DAI phenomenally kept at a steady price throughout 2018 even though there was a 80% drop in the price of Ether, its only source of collateral. Crypto-collateralised can be seen as beneficial as their decentralised nature appears strengthened by their usage of cryptos for collateral. There are many stablecoins out there, hybrid projects have also appeared, trying to mix certain aspects of both the fiat and crypto collateralised methods. Carbon and Reserve are notable hybrid projects. The following are some notable examples of stablecoins currently out there.

Tether

Tether is the authors least favorite fiat collaterazlied stablecoin, it has consistently been the least transparent on the list and is still fighting against a full audit of its books. Each Tether is 100% backed by their reserves which does give it an element of traditional security.

JPM Coin

J.P. Morgan was the first U.S. bank to create a fiat-backed stablecoin, the JPM coin. The bank is using JPM coin for instantaneous payments transfers between its institutional accounts. This allows for automatically viewable updates to the shared ledger.

Gemini Dollar

Gemini Dollar is the first regulated stablecoin. The creators claim to have implemented Blockchain technology with the added creditworthiness and price stability of USD, all with oversight from U.S. regulators.

TrueUSD

Whilst TrueUSD also boasts to be one of the first regulated stablecoins, it is also fully collateralised in USD reserves. It is an Ethereum ERC-20 token.

Libra

Libra is a supposed stablecoin recently announced by Facebook. Although Libra-coin is not yet released, it is the first to have such a mix of Leviathans backing it. It is to be a Proof-of-Stake blockchain, with around 100 organisations all staking large amounts to serve as the collateral, these actors will be validators of the network. Proof-of-Stake allows for scaleability not currently seen in Proof-of-Work blockchains. Libra-coin could possibly work as a way for the global unbanked to have access to online commerce along with general financial inclusion.

The Central Bank of China’s Digital Currency

The Central Bank Digital Currency (CBDC) is a stablecoin created by the state of China. This stablecoin has been developed by the Peoples Bank of China along with the joint backing of four large Chinese financial corporations. However the CBDC is not yet released for public use and is only currently going through ‘closed-loop testing’ via commercial and non-government institutions. Its release date has not been officially announced but is expected early 2020.

DAI

DAI was developed by MakerDAO and is the simplest yet most effective method of pegging a digital currency to the Dollar in a distributed manner. DAI is never actually one Dollar, it is constantly oscillating between 99c and 101c. The way DAI maintains this price is rather genius, discussed here.

Stablecoins may allow crypto-currencies to penetrate the mainstream market by giving users a sense of price security. If you brought trainers today for the amount of Ethereum that is worth $20.00, tomorrow that ETH might be worth $40.00 or $0. This has understandably kept many away from using crypto currencies for general transactions, Stablecoins may provide a very viable option to remedy this.

Joseph Noott(2020.03.11) Stablecoins – What do they mean for cryptocurrency?

retrieved from https://adapptdlt.blog/2019/09/10/dai-king-of-the-stablecoins/