Shinhan Bank and LG CNS CBDC Platform Development Scenario

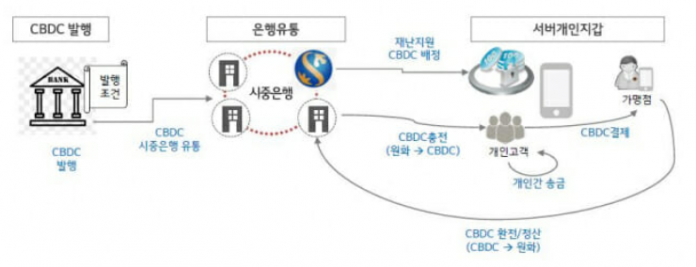

Recently, the central bank, the Bank of Korea, is anticipating a pilot test of digital currency (CBDC), so it is also busy developing a platform that can handle this. Shinhan Bank has already created a pilot platform based on LG CNS’s blockchain that enables ▲CBDC distribution ▲CBDC payments to individuals ▲CBDC used inquiries, payments, remittances, currency exchanges, and recharges.

Domestic banks are highly evaluating the possibility of commercialization of cryptocurrency. A bank official said, “Cryptocurrencies such as Bitcoin and Ethereum can serve as a virtual asset replacing traditional financial assets such as gold or funds, or as a payment method replacing Kakao Pay or credit cards. I expect it to be.”

An official of Bank B diagnosed that “the cryptocurrency settlement market is likely to be commercialized” and that “the exchange ratio between won must be fixed (stable coin) in order to reduce the price volatility of cryptocurrency.”

Domestic banking officials just said, “For commercialization, related regulations and laws should be reorganized so that domestic financial institutions can prepare in terms of business and technology.”