Game stocks are nosediving this year after a gravity-defying 2021 thanks to their connections with the metaverse and non-fungible tokens (NFT), two fads that thrilled punters last year.

Investors are generally jittery about potential interest rate hikes and specifically nervous about the weakness of the cryptocurrency market, which both the metaverse and NFT rely on. Metaverse games have their own crypto tokens that players can buy and use online. NFTs are often traded using cryptocurrencies.

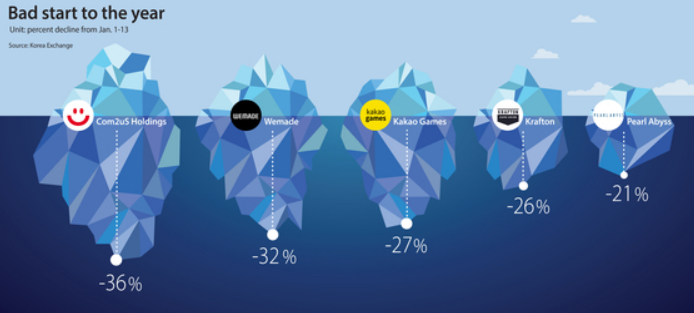

Shares of Krafton, the developer of Battlegrounds, tumbled more than 20 percent this month while NCSoft has slid more than 10 percent. They are the two biggest game developers in Korea by market cap.

The impact on smaller developers has been even stronger.

Shares of Wemade are down more than 20 percent this year, while its subsidiary Wemade Max, a blockchain-based game developer, are down almost 20 percent. Devsisters, known for its Cookie Run game, tumbled 17 percent and Com2uS Holdings more than 30 percent during the same period.

Growth stocks like games are more affected by U.S. Federal Reserve rate hikes than blue chip stocks because “they typically make a lot of investments, especially in technologies and that often entails risks and uncertainties,” said Kim Tae-gi, a former economics professor at Dankook University. “Rate increases raise their cost of borrowing.”

Goldman Sachs said on Monday that it expects the Federal Reserve to raise rates four times this year amid rising inflation and a tightening job market. Fitch Ratings forecasts two rate hikes this year and four in 2023.

Last year, game developers loudly proclaimed ambitious expansion plans into the metaverse and blockchain.

Com2uS Holdings subsidiary Com2uS unveiled a metaverse platform in December, while Wemade launched a blockchain game, “GalaxyTornado on Wemix,” for the global market late last month. It also launched a Play to Earn (P2E) game, Mir4, in August.

P2E games allows users to farm or collect crypto and NFTs that can be monetized in the real world.

Wemade shares soared more than 800 percent last year, and Wemade Max around 1,500 percent. Shares in Com2uS Holdings grew almost 500 percent.

The crypto market crash is terrible for game stocks as many of them plan on expanding services based on metaverse and NFTs, which operate over the blockchain, the technology that enables the existence of cryptocurrency.

Bitcoin tumbled below $40,000 on Monday to its lowest level since September.

“Game companies are trying to find new sources of profit by issuing NFTs or launching P2E games rather than focusing on game development itself,” Dankook’s Kim said. “So the decline in the value of cryptocurrencies [that are the foundation for NFTs and P2E games] is pulling down their profit. The ban on P2E games in Korea is also affecting investor sentiment in game sector.”

The Game Rating and Administration Committee, under the Ministry of Culture, Sports and Tourism, has refused to give an age rating for P2E games, citing concerns about gambling. Receiving an age rating is required for a game to be distributed in Korea. The committee has also requested that existing P2E games be removed from Google Play and Apple’s App Store.

Despite the risks and regulations, investors should pay more attention to the game industry this year because “domestic game developers are planning to launch P2E games relatively faster than global rivals,” said Jung Ho-yoon, a chartered financial analyst from Korea Investment & Securities. The early release of P2E games is important because first movers can enjoy word of mouth without spending much on marketing.

Wemade launched a P2E version of its game Mir4 globally in August. Netmarble and NCSoft are some other game developers launching P2E games this year.

Jin MinJi(2022.01.13) Game stocks discover gravity in 2022

retrieved from https://koreajoongangdaily.joins.com/2022/01/13/business/finance/metaverse-games-p2e/20220113183144937.html