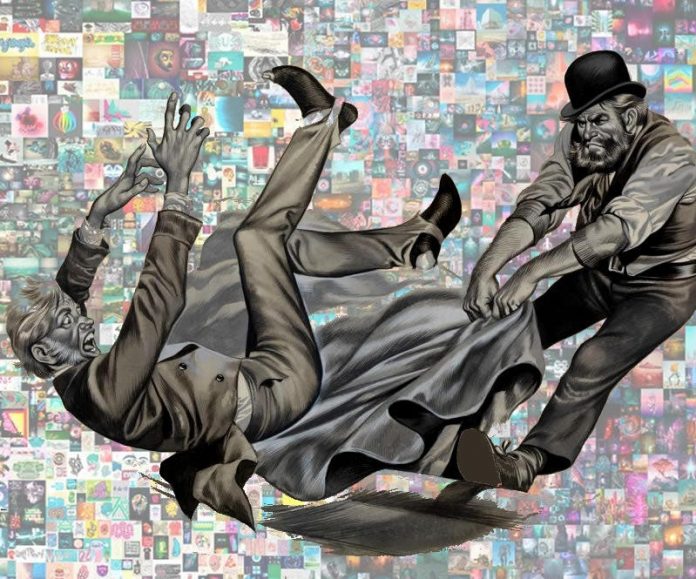

As far as metaphors go, “rug pull” is colorful, tidy, and effective. It assigns malevolence to the people in charge. It paints a portrait of a scam designed and sadistically executed for the express purpose of theft, and it plainly dichotomizes vile aggressor from woebegone victim. But you know what they say—if a metaphor were perfect, it wouldn’t be a metaphor.

Sometimes a bad thing happens but the degree of malevolence can be difficult to nail down. In such a scenario, our metaphor may become a tad clumsy. Take, for instance, the Haru debacle of last month. Days before abruptly terminating the services of 100 employees, the crypto yield firm suspended all withdrawals and deposits. Initially, Haru rolled out the standard, vague platitudes about unforeseen phenomena being the culprit. Later, Haru pointed at B&S Holdings as the malevolent actor. Delio, an affiliated crypto lending firm, suspended withdrawals and deposits at the same time as Haru.

Both firms are now under investigation by Korea’s Financial Services Commission, though details have been inexplicably elusive. It will likely be months or years before a malevolent actor is revealed, and perhaps just as likely that one will never be identified. So, who pulled the rug? The public doesn’t know for sure yet, but to the folks laying in a heap on the floor, that question is secondary to, “Where is that infernal rug now?” (We’re really redlining the metaphor now.) The scammed are unable to touch what was until very recently their money, and they have a desperate desire to know where it all went. Everyone else who dodged this particular bullet is keen to learn how they can recognize and avoid what has become a fate too common in this industry.

Recent reports indicate that class action lawsuits are underway against Haru and Delio, and that prosecutors have stormed the offices and residences of all relevant players to determine the extent of fraud. It’s a bloody mess, and it’s terrible for crypto confidence. Korea has long been among the most bullish and aggressive adopters of crypto, but one has to wonder how many of these sudden closures—temporary or otherwise—investors can suffer before their gold-standard optimism cools. The movers and shakers of the cryptosphere need to take a hard look at themselves and recalibrate for the long game. Yank enough rugs and people will eventually start walking around them. This fiasco is far from over. Be sure to get updates at CoinHubKorea as it all unfolds.