One of South Korea’s biggest conglomerates with roots firmly in traditional industries is taking a leap into the unknown with its next target for growth: the metaverse.

SK Square Co., the investment arm of the massive SK Group spun off into its own stock last month, wants every portfolio company to have a metaverse presence, Managing Director Huh Seok-joon, 48, said in an interview. Their customers should be able to use cryptocurrencies for shopping, streaming media and other transactions with the metaverse community, he said.

Corporations the world over are laying bets on the metaverse, an envisioned virtual environment where people can interact with the internet and others, supplanting web browsers and mobile apps. SK Square is moving swiftly in a bid to avoid falling behind younger, nimbler competitors: it bought a 35% stake in a crypto exchange last month and one of its affiliates is planning to issue a coin in the first half of next year, Huh said.

“Our business needs to evolve into the metaverse,” Huh said. “Our new interface between customers will be shifting from mobile phones to metaverse and coins will be used as new currencies on our platforms.”

SK Square is entering an already-crowded field that’s drawn the likes of Facebook-parent Meta Platforms Inc. and domestic rivals Naver Corp. and Kakao Corp. But these investments will likely take years to pay off, if at all, given the technology and software required to realize their vision of the metaverse remain nascent.

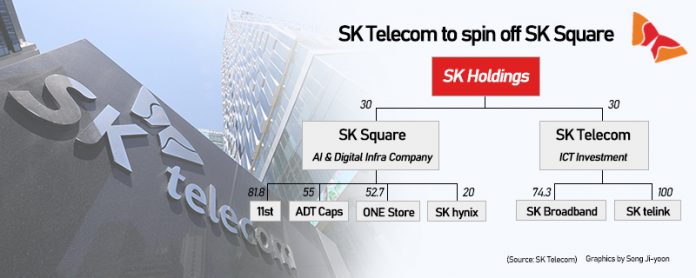

Such radical bets are rare among family-controlled conglomerates, known as chaebol in South Korea, which have been dependent on manufacturing sectors for decades. Seoul-based SK Square, split off from SK Telecom Co., is following a SoftBank Group Corp. model for investments in future technologies.

On its first day of trading last week, SK Square announced a 90 billion won ($76 million) investment in Korbit, South Korea’s fourth-largest crypto exchange. Although Korbit’s share of the Korean market is only about 0.3%, SK Square saw it as a good way to enter the crypto business at a cheap valuation. Dunamu, parent of Korea’s leading crypto exchange firm Upbit, has a valuation of about 17.8 trillion won, according to Seoul Exchange, an unlisted stock trading exchange platform.

SK Square aims to list coins on Korbit that can be used for buying products and services from SK Group companies, starting with one coin and expanding from there, Huh said. SK Square is the largest shareholder of chip giant SK Hynix Inc. and its other portfolio companies include app market firm One Store Co., online shopping mall 11street and ride-services provider Tmap Mobility. SK will eventually issue a coin for SK Telecom-operated metaverse platform called “ifland,” Huh said.

SK Square’s investment comes as South Korea is tightening regulations on crypto activities and outlining laws related to investor protection and penalties on illegal acts. The country has shut down dozens of cryptocurrency exchanges and approved only a few major exchanges including Korbit that require users to register with real names and bank accounts for trading.

Yet SK Square is forging ahead. The company is mulling investments in foreign crypto exchange firms with a vision of establishing an international coin ecosystem, Huh said. It would also consider buying cryptocurrencies including Bitcoin if local restrictions on direct investments in crypto assets are lifted, he said.

“I don’t think cryptocurrency itself is a speculative asset,” he said. “We are aware of the volatility of the price move and need to be careful. But it doesn’t make sense for us to rule out crypto as an investment option.”

Sohee Kim(2021.12.13) Metaverse Riches Lure One of South Korea’s Oldest Conglomerates

retrieved from https://finance.yahoo.com/news/metaverse-riches-lure-one-south-210000441.html