The government is set to establish an integrated system for managing virtual asset disclosure information. This system aims to protect investors by allowing them to verify information from virtual asset issuers in one place, similar to the electronic disclosure system (DART). Currently, the virtual asset market lacks such a system, leading to gaps in investor protection.

The Financial Services Commission (FSC) recently reported to the National Assembly on a plan to establish and operate an integrated disclosure system for virtual assets by a public institution, in accordance with the Virtual Asset User Protection Act. This action follows the supplementary opinions of the National Assembly’s Political Affairs Committee during the enactment of the Virtual Asset Act last year. The FSC plans to report the plan for building and operating the integrated electronic system for virtual asset pricing and disclosure to the National Assembly by next month. Based on this, the National Assembly intends to proceed with the legislation of a second-phase bill encompassing the regulatory framework for virtual asset issuance and disclosure.

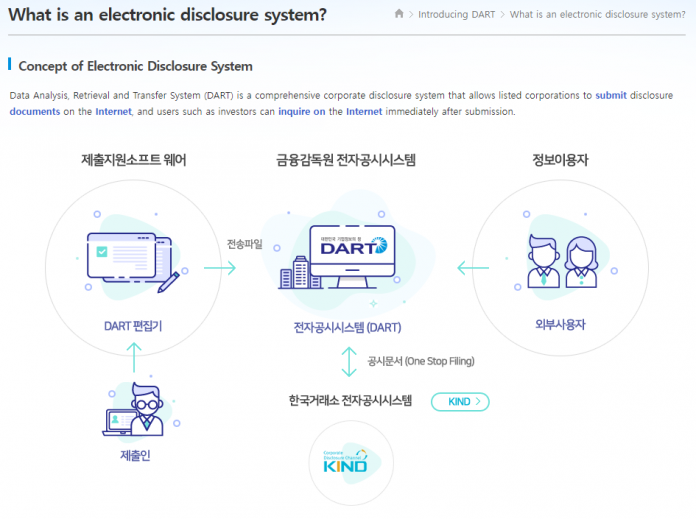

Currently, there is significant opinion within the industry that a system like DART, operated by the Financial Supervisory Service, is also needed in the virtual asset market. However, there is ongoing debate about whether the system should be managed by the government or the private sector. The FSC indicated that the implementation of the system would take time as disclosure regulations are not yet in place.

Experts have pointed out that the evaluation and disclosure in the virtual asset market are not systematically carried out, leading to problems in investor protection. They argue for the mandatory establishment of a disclosure system and the construction of an integrated system to address these issues. It is necessary to systematize the scope and process of disclosures by issuers and to integrate the disclosure contents of various exchanges into a single system.

In this context, the FSC is considering the introduction of a disclosure system to enhance the transparency of virtual asset disclosure information, prevent information asymmetry, and prevent unfair trading practices. Furthermore, the FSC aims to establish a comprehensive regulatory framework and system for the issuance, listing, and disclosure of virtual assets to ensure the fairness and transparency of the market.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)