The Financial Services Commission introduced guidelines on non-fungible tokens (NFTs) on June 10 to provide clear standards and examples on determining when NFTs should be considered as virtual assets.

Download here : 240610 Authorities Introduce Guidelines for Determining When Non-fungible Tokens Qualify as Virtual Assets

Background

A non-fungible tokens (NFT) is a digital token carrying a unique identifier, which makes it irreplaceable (non-fungible). NFTs are issued in limited quantities mostly for trading of digital content, such as videos or images. Due to this tendency, the number of owners for the same NFT is limited as well as the occurrence of secondary market trading, which makes NFTs less prone to large-scale user damages, to which virtual assets are often made vulnerable. In addition, from the perspective of promoting development of blockchain technology and seeking regulatory reforms to this end, NFTs qualify as an advanced digital asset.

Against this backdrop, when the Act on the Protection of Virtual Asset Users becomes effective on July 19 this year, the FSC plans to exclude certain types of NFTs that meet qualified standards from the scope of virtual assets that will come under its legal purview.

However, digital tokens that are presented in an NFT format but in effect qualify as virtual assets will be subject to this law. As this legislation on the protection of virtual asset users will enter enforcement this year for the very first time, the authorities have prepared a set of guidelines to provide clear standards for determining when and how NFTs are considered as virtual assets to help improve predictability and remove obstacles in the application of law.

Regulations in Major Countries

In major countries, the legal characteristics of NFTs are determined not based on their format or technology but depending on their content, or their practical characteristics. In the U.S., NFTs are scrutinized in the same way as for virtual assets to determine whether they qualify as a security and whether to apply securities regulations. In effect, in 2023, the Securities and Exchange Commission decided to sanction an NFT issuer for its failure to comply with the proper securities issuance procedure.

In Japan, financial regulations for securities or virtual assets are applied based on the practical characteristics of NFTs. In 2021, relevant guidelines were issued by a private industry group providing standards on how and when to decide NFTs as securities or virtual assets. The Federal Financial Supervisory Authority of Germany (BaFin) also introduced clear principles, suggesting that an NFT qualifies as a security when it carries rights that are transferable and identical to those of a security, and that an NFT qualifies as a virtual asset when it is used as a payment mechanism or for investment purposes.

Key Guideline Details

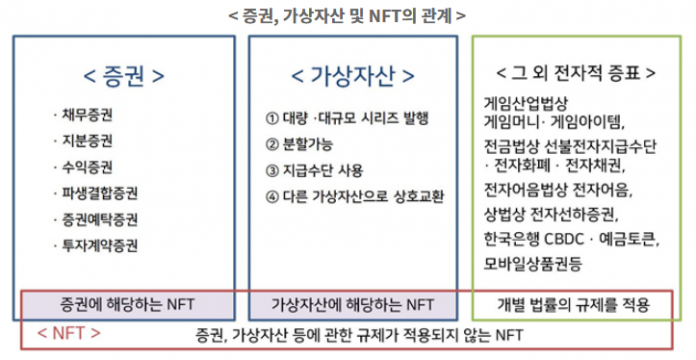

After closely examining the regulatory systems in major countries, the FSC, along with the Korea Financial Intelligence Unit (KoFIU), and the Financial Supervisory Service (FSS) decided to apply the following supremacy principle when enforcing laws on NFTs. First, NFTs shall be scrutinized to see if they qualify as securities under the purview of the Financial Investment Services and Capital Markets Act (FSCMA). Then, NFTs shall be seen in light of the Act on the Protection of Virtual Asset Users to determine if they qualify as virtual assets.

The legal characteristic of NFTs should be determined by the issuers, distributors, and dealers of NFTs based on their practical characteristics after considering wide-ranging factors, such as the issuance and circulation structure, agreement and advertisement, business and service content, and so on.

Determining Whether NFT Qualifies as Security

If the content of rights being acquired by an investor meets the standards of a security under the FSCMA, securities regulations are applied regardless of the format or technology. In this regard, the FSC already issued guidelines on security tokens in February 2023, which can provide an excellent source of reference. Alongside the five formal security types, such as debt securities, equity securities, beneficiary certificates, derivatives-linked securities, and depositary receipts (DRs), a consideration should be given to see whether NFTs qualify as investment contract securities.

Determining Whether NFT Qualifies as Virtual Asset

When an NFT cannot be considered as a security under the FSCMA, then it should be scrutinized to see whether it has characteristics of a virtual asset under the Act on the Protection of Virtual Asset Users. In the Enforcement Decree of to the Act, NFTs that are excluded from the scope of virtual assets subject to this law will be defined as digital identifiers that are unique and irreplaceable (non-fungible), used mostly for the purpose of content collection or verification of transactions between users, which cannot be used as payment methods for goods or services. Therefore, it is highly likely that an NFT can be considered as a virtual asset if it fails either the “singularity” (uniqueness) or “irreplaceability” (non-fungibility) test.

The following cases show examples where NFTs are likely to be considered as virtual assets.

a) When identical or similar types of NFTs are being issued in large quantities or in a series. For example, when identical or similar types of NFTs are being issued in large quantities, which cannot be seen to pass the “uniqueness” test in any commonsensical view, or when identical or similar types of NFTs are forming market price for which trades take place to hunt for margins—not on individual NFTs’ prices—but on the whole group of identical or similar types of NFTs.

b) When it is possible to split an NFT. For example, when an NFT can be split into factional units.

c) When it is possible to use an NFT as a direct or indirect method to pay for certain goods or services.

d) When it is possible to use an NFT as a means to exchange for virtual assets among unspecified individuals, or when it is possible to be used as a means for payment for goods or services linked to other types of virtual assets. Specific examples may include the cases where an NFT is issued for the sole purpose of exchanging into other types of virtual assets, when exchanging between NFTs and other types of virtual assets is made possible among unspecified individuals, or when receiving goods or services priced in other types of virtual assets is possible using an NFT.

On the contrary, the following cases show examples where NFTs are not likely to be considered as virtual assets.

a) When the purpose and utility of issuing and distributing an NFT is not for seeking economic value. For example, when an NFT is used solely for the purpose of verifying identity or credentials, certifying the balance of assets or the record of transactions, and so on.

b) When an NFT’s economic function is limited in terms of the places where it can be used and the utility. For example, when exhibition or concert tickets are issued in the form of NFTs in limited quantities to be used solely for the purpose of attending specific exhibitions or concerts.

c) When an NFT is unlikely to be viewed as a digital identifier that is transferable. For example, when it is not possible to trade it in a secondary market.

A Note for Business Entities

After reviewing the characteristics of NFTs in accordance with the guidelines, when NFTs are deemed to meet the characteristics of virtual assets, businesses should comply with the relevant laws, such as the Act on the Protection of Virtual Asset Users and the Act on Reporting and Using Specified Financial Transaction Information, as well as relevant announcements made by the government.

Business entities that are currently circulating and handling NFTs need to first determine whether the NFTs they are dealing with qualify as virtual assets, and second, should see whether the nature of their business operation involves selling, purchasing, exchanging, transferring, keeping or managing, or acting as a broker, intermediary, or agent of these services involving virtual assets. Those that fit the description of both criteria should register as virtual asset service providers (VASPs) pursuant to the Act on Reporting and Using Specified Financial Transaction Information. A failure to register may result in criminal penalties. Those that need to register should take appropriate steps prescribed by the Act on Reporting and Using Specified Financial Transaction Information, such as suspending the distribution or handling of NFTs that qualify as virtual assets, registering with the authority, and so on.

For those that are planning to issue, distribute, or handle NFTs in the future, it is advised that they follow the guidelines announced today to closely examine the legal characteristics of relevant NFTs and comply with relevant laws and government announcements on virtual assets depending on the practical characteristic of NFTs.

Further Plan

The financial authorities plan to operate a taskforce or issue further announcements if needed to make sure that details of the guidelines are widely available and effectively disseminated.

With the Act on the Protection of Virtual Asset Users scheduled to take effect on July 19, the financial authorities will continue to make efforts to foster stable market conditions for virtual asset users.