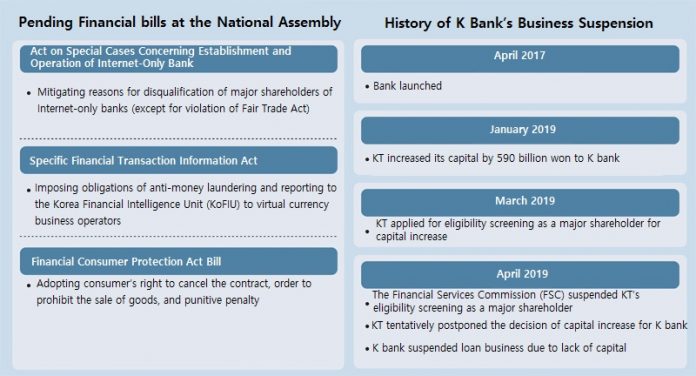

According to the National Assembly and financial authorities on the 16th, Revised Act on Special Cases Concerning Establishment and Operation of Internet-Only Bank, Financial Consumer Protection Act Bill, and Revised Specific Financial Transaction Information Act are pending at the Legislation and Judiciary Committee.

K bank, ‘original’ Internet-only bank’, is seeking to pass the Revised Act on Special Cases Concerning Establishment and Operation of Internet-Only Bank, which eases the requirements for major shareholder eligibility.

K bank had a difficult time suspending the eligibility screening of major shareholder in April last year as KT, an actual major shareholder, was investigated on suspicion of violating Fair Trade Act. As a result, K bank failed to expand capital and it has stopped selling its major loan products.

The Revised Act on Special Cases Concerning Establishment and Operation of Internet-Only Bank is to adjust the reason for disqualification of the major shareholders of Internet-only banks. This revised bill removes the “Violating the Fair Trade Act” section from the clause “If you have received criminal penalties beyond fines for violations of financial laws and fair trade laws for the past five years.”

The revised bill passed the National Policy Committee in November last year but failed to pass the Legislation and Judiciary Committee. This is because a small number of members of Legislation and Judiciary Committee, including Chae Yi-bae from BAREUNMIRAE Party, have raised the issue of preferential controversy over KT. The Legislation and Judiciary Committee should reach unanimous agreement in accordance with custom.

On the other hand, the financial sector raised concerns that if the law is not revised, the monopoly of Kakao Bank can be consolidated. It is also pointed out that under the current legal system not only KT but also new information and communications technology (ICT) companies seeking to enter the banking industry may lose their major shareholder status due to the same regulation.

A K bank official said, “The most obvious way to normalize business is to amend the law.”

The Revised Specific Financial Transaction Information Act is attracting a lot of attention from the industry in that the virtual currency (cryptocurrency or virtual asset) industry is being introduced into the system.

The purpose of this bill is to impose anti-money laundering obligations on virtual currency business operators and to provide standards for financial companies dealing with the virtual currency business operators. The bill requires virtual currency business operators to report business to the KoFIU. As the virtual currency business operators enter under the supervision and management system of financial authorities, the industry interprets them as the first step in entering the system.

Kim Kang-rae, Jeong Ju-won(2020.02.16) 케뱅·암호화폐 `운명`…임시국회서 결판

retrieved from https://www.mk.co.kr/news/economy/view/2020/02/159232/