Aiming to better protect consumers from the uncontrolled cryptocurrency market, the government announced, Friday, a set of measures to strengthen monitoring and supervision of the nation’s virtual asset markets.

The announcement followed a vice-ministerial taskforce meeting held earlier in the day, participated by key officials from cryptocurrency-related government agencies and ministries, including the Financial Services Commission (FSC), the Ministry of Economy and Finance, the Ministry of Science and ICT and the Ministry of Justice. Minister Koo Yun-cheol of the Office for Government Policy Coordination, presided over the ministerial meeting.

The participating government ministries vowed to increase the level of transactional transparency in cryptocurrency trading, as a way to bolster preventive measures against illegal activities. In order to increase transparency, the government plans to strengthen supervision on local cryptocurrency exchanges. The prosecution and police will strictly monitor any illegal schemes related to virtual assets to minimize consumer losses.

Secondly, the government announced that the FSS, the country’s financial regulator, will take full responsibility for managing and supervising local cryptocurrency exchanges, as well as devising related policies. The Ministry of Science and ICT will develop and support blockchain technologies.

The government also stressed that it has continued working on building a legal framework surrounding the cryptocurrencies. It revised the “Act on reporting and the use of certain financial transaction information” which raised transparency by requiring cryptocurrency exchanges to verify identities more strictly and require and real-name banking accounts.

Cryptocurrency exchanges that fall short of the requirements will be provided with consulting services to help them become compliant by late-September.

As cryptocurrency exchanges that fail to meet the requirement will be forced to close down, the government vowed to keep informing the market about the possibility of shutdowns, so that consumers can prepare themselves from any losses incurred. Related information can be checked at the website of the Financial Intelligence Unit (FIU).

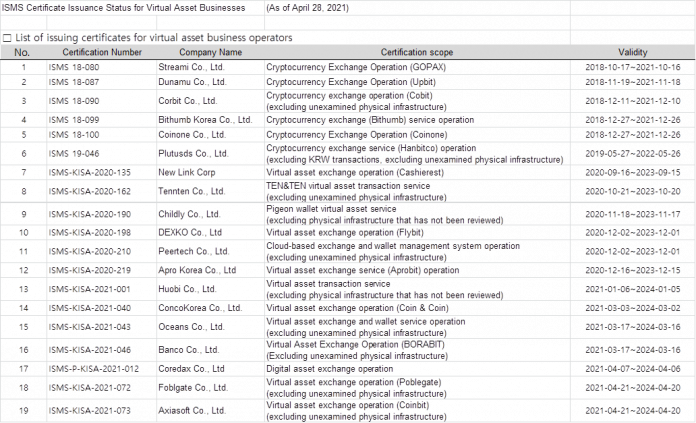

Currently, only four exchanges ― Upbit, Bithumb, Korbit and Coinone ― out of around 60 nationwide as of the end of May have met the legal requirement of using real-name banking accounts only.

20% taxation on cryptocurrency trading

Friday’s announcement also reiterated the government’s plan to start taxing cryptocurrency transactions starting in 2023. As the actual taxation starts from 2023, profits from coin trading will be subject to 20 percent taxation starting from January 2022. Non-resident and foreign legal entities will be taxed on their profits earned from January 2022 by cryptocurrency exchanges, which in turn pay the taxes to the National Tax Service (NTS) and Korea Customs Service (KCS).

The NTS and KCS will also add their share in the government efforts, as they systemically prepare for taxation of cryptocurrency trading, while joining hands with the prosecution and police on curbing illegalities surrounding the cryptocurrency market.

The government also boasted that the number of investigations into virtual asset scheme cases has increased from 62 back in 2018 to 333 in 2020.

Vowing to cooperate closely among related ministries to implement decisions made at the crypto taskforce ministerial meeting, the government stressed that it will continue to work on improving the policies and legal systems, while listening to market participants as well as experts.

박지원(2021.05.28) FSC to supervise cryptocurrency exchanges; ICT ministry to support blockchain sector

retrieved from https://m.koreatimes.co.kr/pages/article.asp?newsIdx=309589