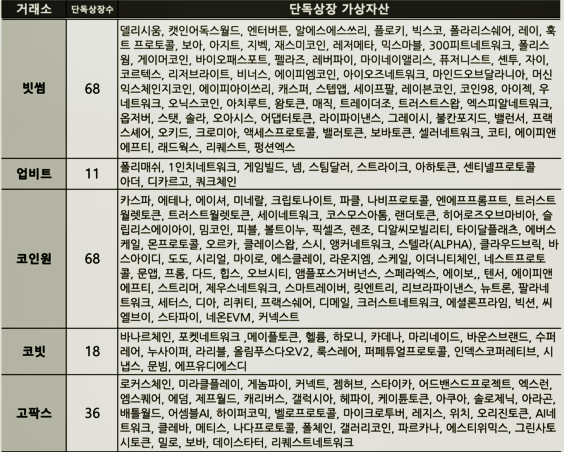

Starting from the 19th, major domestic cryptocurrency exchanges in South Korea will begin re-evaluating over 1,333 cryptocurrencies that are currently supported for trading. This action follows the announcement of the “Best Practices for Cryptocurrency Trading Support,” although it has been clarified that cryptocurrencies violating the evaluation criteria will not be immediately delisted.

According to a domestic cryptocurrency exchange representative on the 2nd, the re-evaluation, based on the announced best practices, will take place over six months. If issues are found during the re-evaluation, the cryptocurrency will first be designated as an “investment warning item.” The project team behind the cryptocurrency will then have an opportunity to address the issues by submitting necessary documentation. If the issues are adequately resolved, the warning designation will be lifted, and normal trading support will continue. If the issues are not sufficiently addressed, the cryptocurrency will proceed towards delisting.

The 20 domestic cryptocurrency exchanges and the Digital Asset Exchange Association (DAXA) have released the “Best Practices for Cryptocurrency Trading Support,” which outlines the necessary evaluation criteria for listing cryptocurrencies. These best practices will officially come into effect on the 19th, alongside the Cryptocurrency Users Protection Act, and will be uniformly applied across domestic exchanges. Since last month, exchanges have been trialing these best practices, and for cryptocurrencies already supported as of the effective date, a re-evaluation will be conducted over the following six months.

The cryptocurrency industry does not expect a large-scale delisting, which some users have feared, due to these best practices. According to DAXA, the five major won-based exchanges in South Korea have already been applying the key evaluation criteria of the best practices proactively since the end of last year through the Cryptocurrency Trading Support Task Force. From January to June this year, there were a total of 39 cases of trading support termination among the five major won-based exchanges, indicating that a sudden mass delisting is unlikely.

Measures to protect users in the event of trading support termination are expected to remain at current levels. Each exchange will disclose the termination of trading support on their websites and provide guidance on settlement trading periods, withdrawals, and handling plans for the affected cryptocurrencies.

With the establishment of these best practices, cryptocurrency exchanges will enhance both formal and qualitative evaluation criteria, aiming to increase the transparency of transactions and strengthen user protection. This initiative is expected to have a positive impact on the industry’s stability and credibility.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)