The global cryptocurrency trading platform Binance, the major shareholder of the South Korean cryptocurrency exchange GoPax, is examining the option of selling its GoPax shares as a strategy to re-enter the Korean market. This move aims to address the approval issues related to the Virtual Asset Service Provider (VASP) registration with regulatory authorities. Following its acquisition of GoPax (operated by Streami) in March last year, Binance has decided to take this step to overcome legal risks and capital issues that have emerged.

Steve Young Kim, Binance’s Director for the Asia-Pacific region, recently announced at a Binance roundtable that the company plans to continue reducing its stake in GoPax. Currently holding a 72.26% stake in Streami, GoPax’s operating company, Binance intends to increase this to as much as 80% through debt-to-equity swaps and then sell off shares while retaining just enough to exercise decision-making rights.

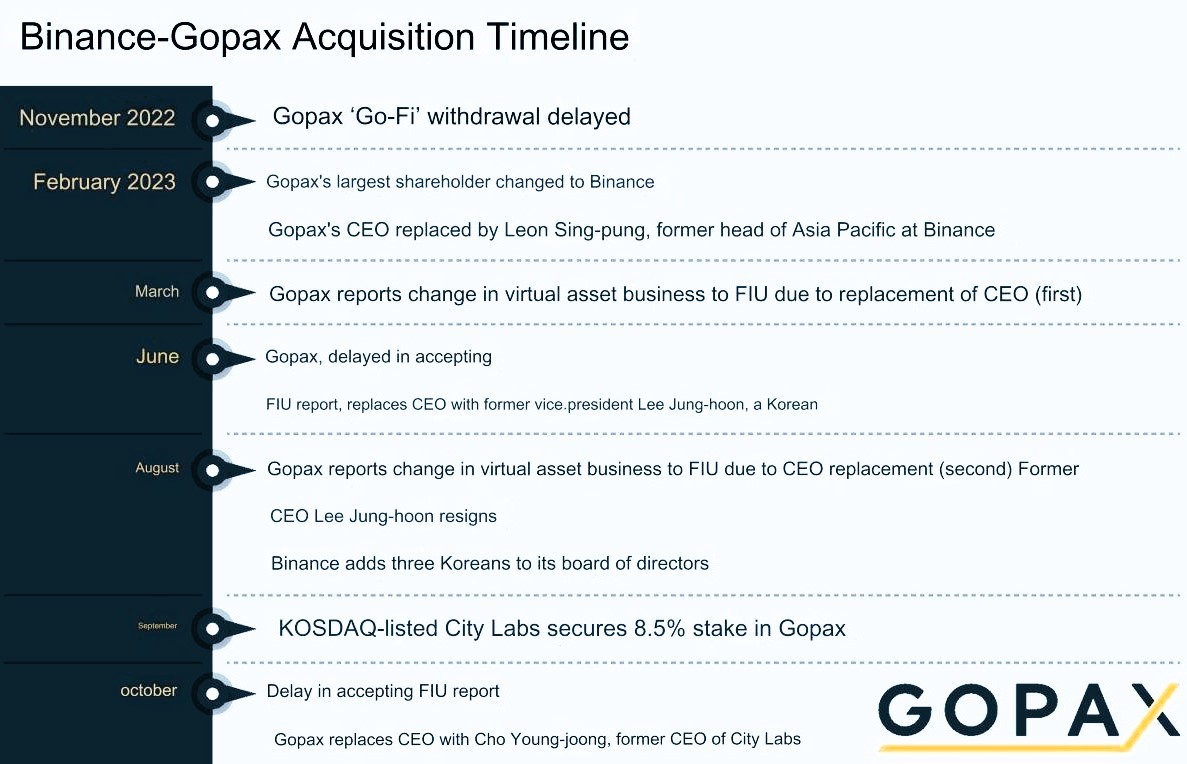

CityLabs, a company listed on the KOSDAQ, is considered a strong candidate for acquiring the shares. Last year, CityLabs acquired an 8.55% stake in GoPax and has played a crucial role as a ‘savior’ amidst the VASP registration issue between Binance and the financial authorities. However, the industry remains skeptical about whether the sale of shares to CityLabs will address the VASP issue effectively, given the regulatory concerns about legal risks and the extent of Binance’s reduced influence.

Moreover, GoPax is facing critical deadlines this year for VASP renewal and the expiration of its KRW contract, making Binance’s plan to sell shares a last-resort strategy in the eyes of the industry. As the expiration date of the contract between GoPax and Jeonbuk Bank approaches, Binance explores various strategies to ensure GoPax’s VASP registration is approved.

GoPax investors have held protests demanding the financial authorities to approve Binance’s acquisition of GoPax, urging compliance with the Special Payment Act. They argue that the completion of Binance’s acquisition process is necessary for the repayment of principal and interest. They have appealed for a swift decision from the financial authorities.

Industry insiders highlight the potential benefits of Binance’s share sale strategy in meeting the demands of the authorities but also note the downsides, such as reduced global capital inflow and growth prospects for GoPax that were anticipated with Binance’s acquisition. The decision’s impact on both GoPax and Binance, amid regulatory scrutiny and investor appeals, is closely watched by the industry.