Last week it was announced that the FTX clean-up crew unearthed another USD $800 million from the couch cushions, bringing the total of recovered funds to $7.3 billion. Bit by bit, attorneys and investigators are locating and itemizing the funds that were either lost, spent, or casually misplaced during the reign of Sam Bankman-Fried.

The likelihood of total recovery is still slim, but the amount reclaimed so far is nothing to scoff at. At the very least, it presents FTX with some semblance of choice. In a step that would have been unthinkable five months ago, the new executive team at FTX, including CEO John Ray, have floated the idea of relaunching the bankrupt crypto exchange sometime in the first half of 2024.

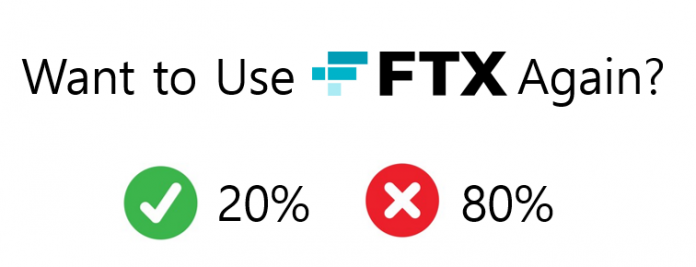

It’s commonly said that everybody loves a comeback story, but the revival of this disgraced exchange might very well dispel that narrative. CoinHubKorea surveyed over 1000 Korean traders and just over 80% said they would never trade on FTX again, even if every employee, logo, and piece of furniture were replaced. South Korean sentiment regarding any future “reboot” is worth studying, considering the nation was the top trading volume region for FTX.

Another option for FTX would be to prioritize the return of funds. When the exchange collapsed last November, investors, partners, and contractors of FTX were abruptly shut out from access to their assets. It is perhaps reasonable and ethical that the restoration of these parties’ funds should take precedence over new, speculative ventures.

Whether it’s FTX 2.0 or some other exchange that eventually pops up on Korean shores, one thing is certain: it would behoove a global player to pay particular attention to the needs of South Korea. The volume they move is second to none, and they are the kingmakers of digital exchanges

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)