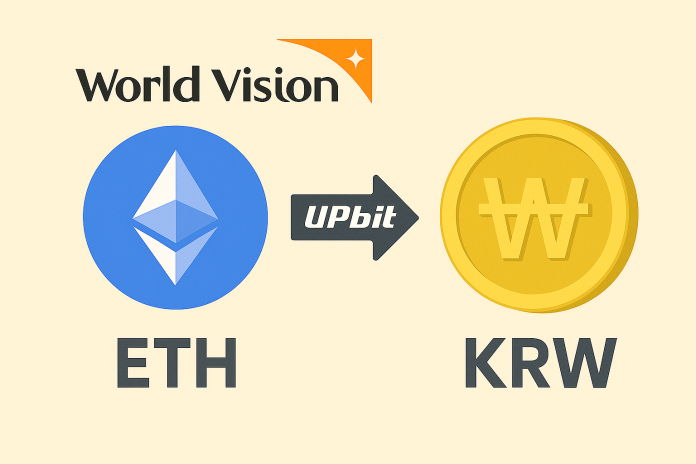

A major milestone has been reached in South Korea’s digital asset landscape. Non-profit organization World Vision has successfully conducted the first-ever cryptocurrency transaction under a corporate account through Korea’s largest exchange, Upbit, marking a new chapter in institutional access to crypto markets.

In this historic transaction, World Vision sold 0.55 Ethereum (ETH)—received as a donation—via an Upbit account linked to a corporate bank account at K-Bank. The crypto was converted into approximately 1.98 million KRW, making it the first time in Korea that a legal entity has officially traded crypto using a verified corporate account.

The trade was made possible under the “Roadmap for Corporate Participation in the Virtual Asset Market,” announced by Korea’s Financial Services Commission (FSC) in February 2025. The roadmap permits qualified non-profit entities to open crypto exchange accounts and convert digital donations into fiat, under strict eligibility requirements.

To meet these standards, World Vision was required to fulfill several conditions, including:

-

Official designation as a donation-eligible corporation under Korean tax law

-

An “unqualified” audit opinion over the past three years

-

The establishment of internal control systems such as a donation review committee

-

Use of only high-liquidity assets listed on at least three domestic exchanges

-

Public disclosure of transaction plans, outcomes, and fund utilization

This transaction not only establishes a new precedent but also showcases how crypto donations can be transparently and compliantly converted into usable funds by legitimate organizations. Upbit’s operator, Dunamu, announced plans to expand access to listed companies and registered professional investment firms in the coming months, with the FSC expected to begin issuing corporate-level verified bank accounts by the second half of 2025.

Beyond the technical and regulatory implications, this case represents a symbolic first step toward integrating digital assets into mainstream institutional finance. It also paves the way for broader adoption of crypto in corporate treasury, charitable funding, and strategic asset management.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-324x235.jpeg)