In June 2023, South Korea’s cryptocurrency industry was rocked by the Haru Invest scandal, where over 16,347 investors lost a staggering 1.39 trillion KRW (over $1 billion USD). The company, which promised high returns through secure asset management, suddenly froze withdrawals, leaving thousands of investors in financial ruin. With company executives facing criminal charges and lawsuits ongoing, the victims’ hopes for compensation remain uncertain.

The Collapse of Haru Invest: A Web of Lies

Haru Invest, founded in 2021, grew rapidly, promising to increase the number of coins investors held rather than focusing on short-term gains. They advertised a strategy of diversifying assets across more than 10 companies, offering annual returns of 12-20%. However, when the company froze withdrawals in June 2023, it soon became apparent that their promises were false.

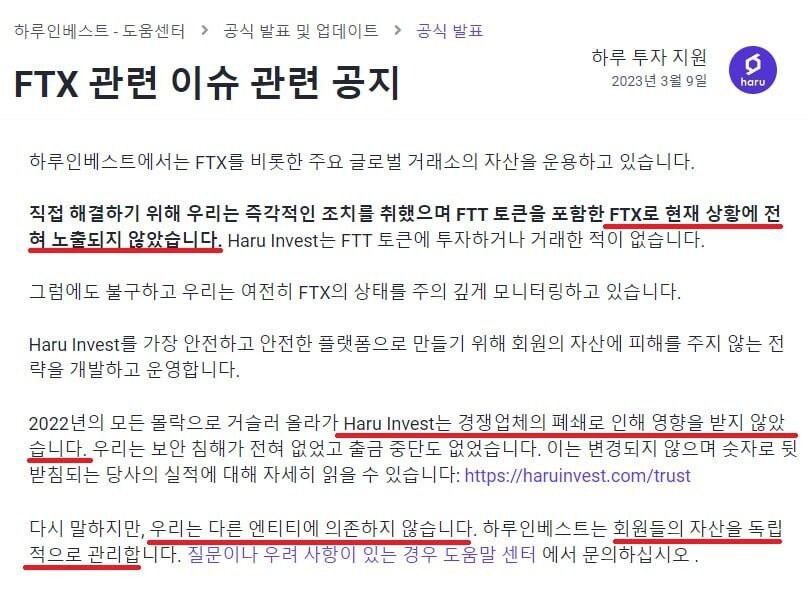

Prosecutors revealed that Haru Invest had been insolvent since 2019, mixing customer assets with company funds. Contrary to their claims of diversified investments, Haru had placed more than 80% of their clients’ assets into a single firm, B&S Holdings, run by a key figure, Joon-ho Bang. Most of these funds were either lost or frozen due to the collapse of the FTX exchange.

Desperate Victims and CEO Assault

As the company failed to resolve the withdrawal issue, victims’ frustrations boiled over. In August 2024, an investor attacked Haru Invest CEO Hyung-soo Lee in court with a weapon, symbolizing the desperation many investors feel. The attacker had invested over 100 Bitcoin, which was worth more than 10 billion KRW ($7.5 million) at its peak. Now, the investor is struggling to survive, living off instant noodles and estranged from family.

A fellow investor, A, explained: “Most victims don’t support violence, but that incident shows just how desperate some people have become.” He described another case where an investor, after putting 9 billion KRW into Haru Invest, is now homeless and wandering.

The FTX Claim: A Faint Glimmer of Hope

The last hope for many Haru Invest victims lies in claims related to FTX’s bankruptcy. As FTX restructures its assets, there’s potential for creditors to recover 118% of their claim value, thanks to the skyrocketing value of FTX’s stake in Anthropic, an AI company. However, Haru Invest’s situation is more complicated. Joon-ho Bang, who controlled B&S Holdings, transferred Haru’s FTX claims to his company, Lemma Technologies. Rumors indicate that these claims were sold to U.S. distressed debt firm Attestor at a 30% discount.

Victims are anxiously waiting to see whether these claims can be recovered. If Attestor indeed holds the claims, victims may see less than 10% of their funds. However, if Haru retains ownership of the FTX claims, victims could potentially recover around 20-25% of their losses.

Legal Battle and Haru Invest’s Silence

The legal battle surrounding Haru Invest is complicated by the company’s use of offshore entities to evade responsibility. In court, Haru Invest claimed that “Haru Invest Korea is just a marketing company,” and that contracts were actually with a separate Singaporean entity, shifting liability away from their Korean branch.

Since CEO Hyung-soo Lee’s arrest in February 2024, Haru Invest has been silent. Victims feel abandoned, accusing the company of issuing meaningless apologies without providing concrete plans for asset recovery.

Lingering Desperation

The Haru Invest scandal highlights the risks of cryptocurrency investment and exposes regulatory gaps in the industry. While victims have abandoned hope for full reimbursement, they still yearn for sincere apologies and maximum possible compensation.

A, one of the victims, expressed the ongoing despair: “This isn’t just a financial scam—it’s destroyed lives. We need the truth and real efforts to recover what we can.” As the legal battle drags on, victims are left waiting for a resolution that still seems far from reach.