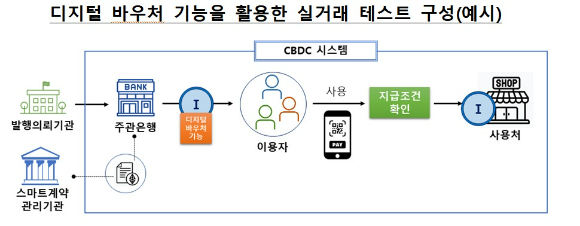

Central bank digital currency (CBDC) usability testing will be conducted on up to 100,000 ordinary people in the fourth quarter of next year. When participating banks issue deposit tokens, ordinary participants can use CBDC in actual commerce through deposit tokens with a digital voucher function.

This test will be divided into a real transaction test involving actual citizens and a technology experiment conducted in a virtual environment. The real transaction test is conducted in such a way that the bank issues a deposit token incorporating digital won technology, and the user purchases goods with the deposit token and pays the money to the user.

Here, banks are allowed to issue deposit tokens through the financial regulatory sandbox, and perform roles such as recruiting and managing experiment participants (individuals and stores, etc.), developing user wallets, and paying usage fees. Banks participating in the real-time transaction test plan to go through related procedures such as the financial regulatory sandbox and confirm it before the end of the third quarter of next year.

Currently, the government and companies are issuing various vouchers such as subsidies and gift certificates, but problems such as high fees, complicated settlement processes, and concerns about fraudulent supply have been pointed out. This test focused on improving these. In particular, it is expected that there will be a high possibility of improving this if the digital voucher function is applied to CBDC-based deposit tokens, etc. by utilizing the programming function, which is the biggest feature of digital currency.

General users participating in the real-time transaction test will apply through participating banks around September to October next year, and the number of participants will be limited to a maximum of 100,000. The detailed qualifications of participants, such as age group, have not yet been determined.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)