Deceiving customers to embezzle cryptocurrencies worth 1.4 trillion won, the case of the cryptocurrency deposit service company HaruInvest started from a state of capital impairment, as revealed. The investigation by the Joint Investigation Team on Cryptocurrency Crimes of the Seoul Southern District Prosecutors’ Office showed that the fraud was structured around promising high returns of 12~16% annually through a so-called ‘algorithmic trading’ technique, which claimed no risk. However, in reality, the internal management team failed to manage even 10% of customer cryptocurrencies, entrusting a substantial amount to unqualified operators in a Ponzi scheme.

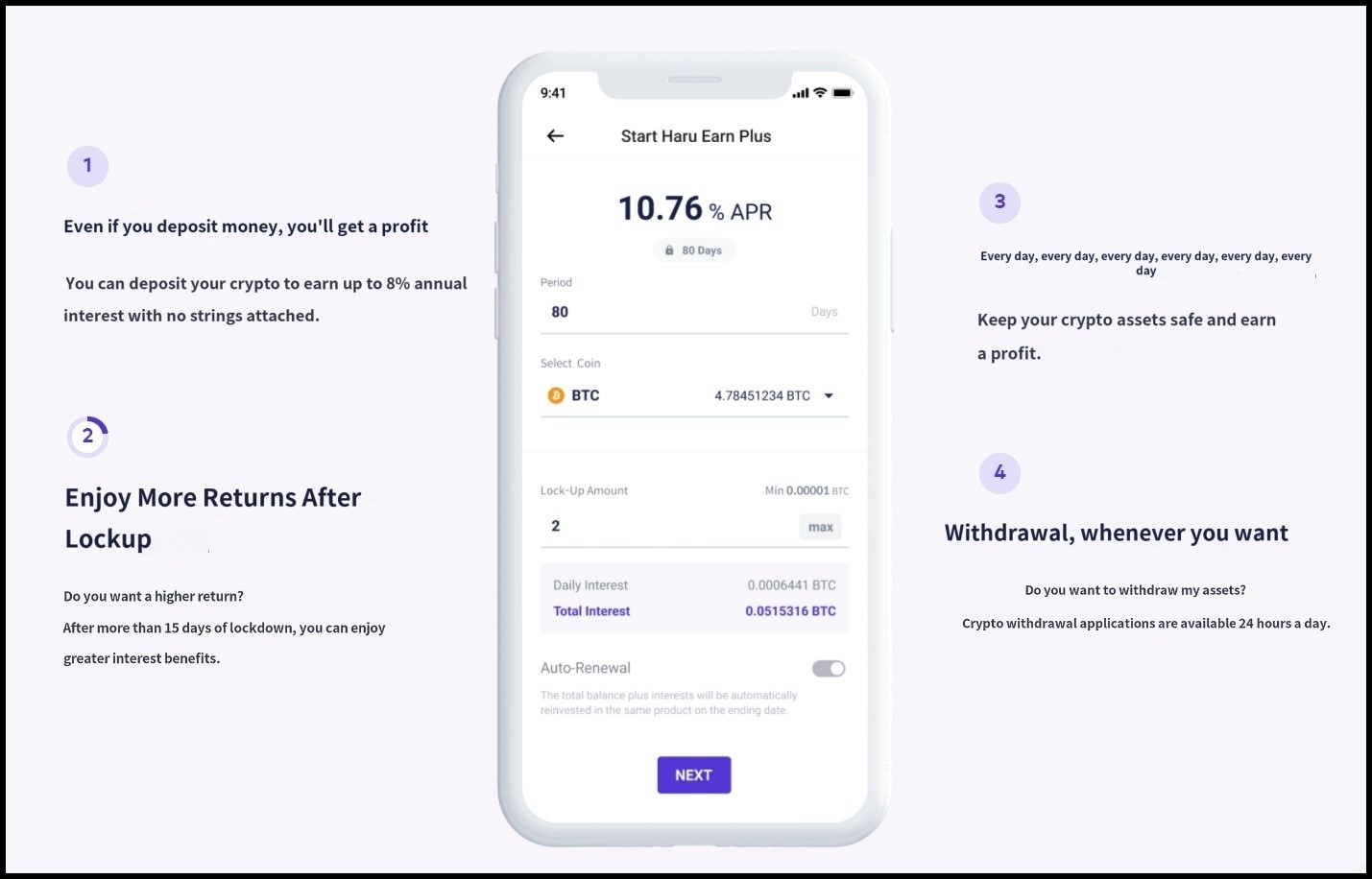

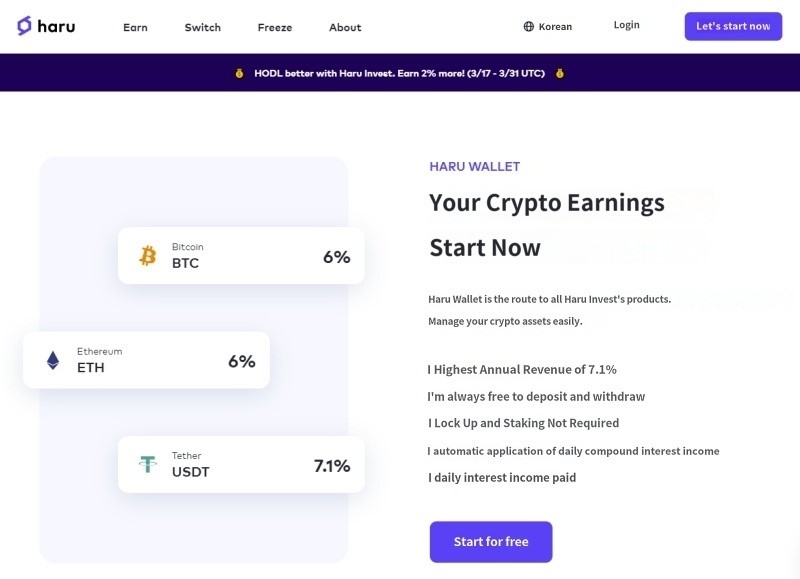

BlockCrafters and its subsidiary, HaruInvest, launched a business that promised to pay interest-like earnings if cryptocurrencies were deposited with them, selling the ‘HaruWallet’ product that allowed for the deposit and withdrawal of cryptocurrencies anytime, along with daily interest payments. While the company promised annual returns and principal protection of 12~16%, it was actually in a state of capital impairment at the time of launch. They began using customer’s cryptocurrencies to pay for operating expenses, including employee salaries and debt repayments.

According to the prosecution’s investigation, HaruInvest entrusted the majority of the assets to unqualified operators, with the internal management team effectively managing less than 10% of the total cryptocurrencies. Especially after incurring massive losses in mid-2021, the company practically halted cryptocurrency operations under the guise of technical issue corrections. Despite these circumstances, BlockCrafters spread manipulated earnings certification posts extensively through social media and online cafes to lure investors.

The key executives involved in the case have been charged with fraud under the Act on the Aggravated Punishment, etc. of Specific Economic Crimes, accused of embezzling cryptocurrencies worth 1.394 trillion won from 16,347 investors. The prosecution is focusing on revealing how the Ponzi scheme operated by these individuals has caused losses to investors. Lawyers are hopeful that the truth will be unveiled in court, highlighting the severity of this case as a fraud that targets investors worldwide.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)