The domestic virtual asset market is undergoing rapid changes. The implementation of the Virtual Asset User Protection Act and the impending deadline for the renewal of Virtual Asset Service Providers (VASPs) are expected to lead to a wave of bankruptcies among coin market exchanges. Additionally, the “One Exchange, One Bank” regulation is allowing only KRW market exchanges to survive, putting coin market exchanges at a disadvantage.

With the enforcement of the Virtual Asset User Protection Act starting on July 19, exchanges are required to secure insurance or reserves to compensate for damages from incidents such as hacking and system failures. KRW market exchanges must accumulate reserves of at least 3 billion KRW, while coin market exchanges need at least 500 million KRW. This additional financial burden is pushing many coin market exchanges to opt for closure.

According to the Financial Intelligence Unit (FIU), 41% (9 out of 22) of currently operating coin market exchanges have already ceased services or plan to do so. This trend is expected to accelerate as the VASP re-registration deadline approaches, with strengthened supervisory regulations leading to the revocation of VASP status for many exchanges.

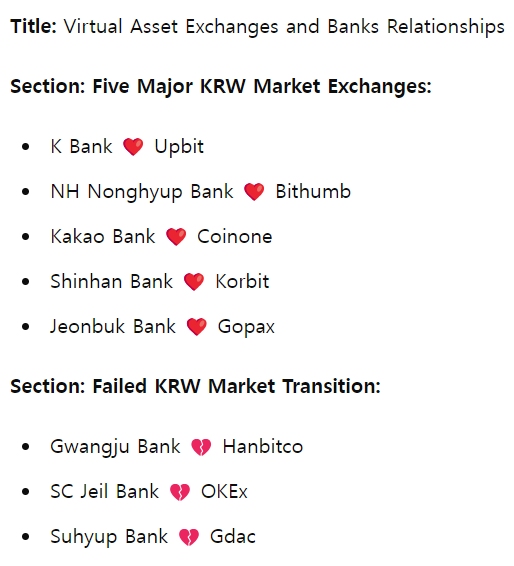

The “One Exchange, One Bank” regulation, which requires each exchange to have a real-name account contract with a single bank, is benefiting KRW market exchanges. Currently, the banks with such contracts are K Bank (Upbit), NH Nonghyup Bank (Bithumb), Kakao Bank (Coinone), Shinhan Bank (Korbit), and Jeonbuk Bank (Gopax). These exchanges are expanding their market share, while coin market exchanges without bank partnerships are shutting down.

Gdac, a coin market exchange, attempted to transition to a KRW market but failed and subsequently closed its services on July 16. Hanbitco also tried but failed to convert to a KRW market and ended its operations. Other exchanges like Huobi Korea, Probit, and Tennten are facing similar challenges.

An industry insider stated, “Existing coin market exchanges with declining profits are facing even greater difficulties due to the additional regulations, likely leading to more closures.” With the VASP license renewal deadline approaching, financial authorities are expected to apply stricter guidelines, prompting exchanges to consider shutting down rather than renewing their licenses.

These regulatory changes are expected to restructure the virtual asset market around KRW market exchanges, and coin market exchanges will need to consider entering the KRW market to survive. However, for small and medium-sized coin market exchanges, entering the KRW market remains a challenging task.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)