The South Korean government is intensifying discussions over the possibility of including cryptocurrencies as strategic reserve assets. However, conflicting positions among key ministries and public institutions have raised concerns about policy coherence and direction.

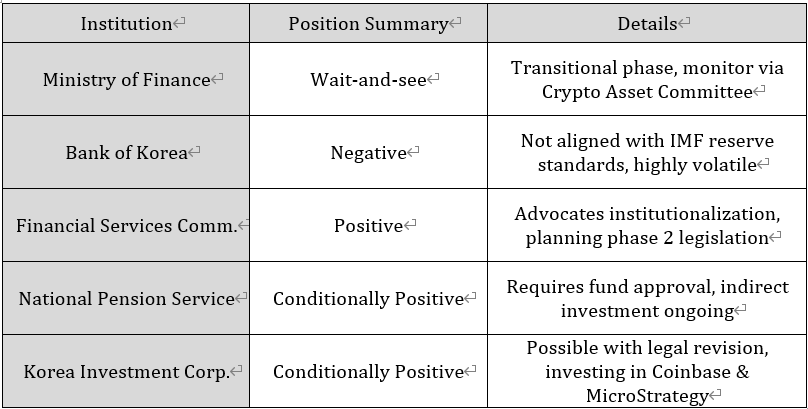

The Ministry of Economy and Finance (MOEF) has taken a wait-and-see approach, citing the current environment as transitional. They plan to observe market trends through a newly formed “Crypto Asset Committee.” In contrast, the Bank of Korea (BoK) opposes the idea, stating that crypto assets do not meet IMF foreign reserve asset criteria and are too volatile to serve as reserve assets.

Summary of Institutional Positions

On the other hand, the Financial Services Commission (FSC) supports institutionalization and has announced plans for a policy advisory group and a two-phase legislative process. Meanwhile, the National Pension Service (NPS) and the Korea Investment Corporation (KIC) have shown conditional willingness, noting that investments could be considered once legal and institutional safeguards are in place.

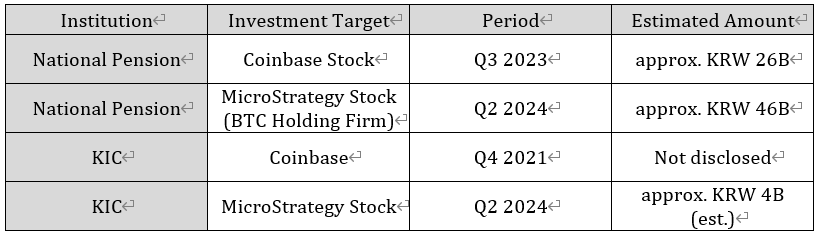

In practice, both institutions have already entered the crypto space through indirect investments in crypto-related equities. NPS acquired approximately 280,000 shares of Coinbase in Q3 2023 (worth around 26 billion KRW) and about 245,000 shares of MicroStrategy in Q2 2024 (worth approximately 46 billion KRW). KIC has been investing in Coinbase since Q4 2021 and purchased an additional 21,000 MicroStrategy shares in Q2 2024 (estimated at 4 billion KRW).

Actual Indirect Investment Status

While countries like the United States and the United Kingdom are taking bold steps to formalize digital assets as part of national reserves, South Korea faces a crucial moment. Without coordinated policy alignment, the opportunity to take a leading position in digital finance could be lost. Lawmaker Ahn Do-geol emphasized the urgency of creating a comprehensive regulatory framework, including asset reserve planning, STO legalization, spot ETFs, stablecoin issuance, tax system upgrades, and foreign corporate investment access.

The future of South Korea’s digital financial sovereignty may well depend on the choices made in this critical period.