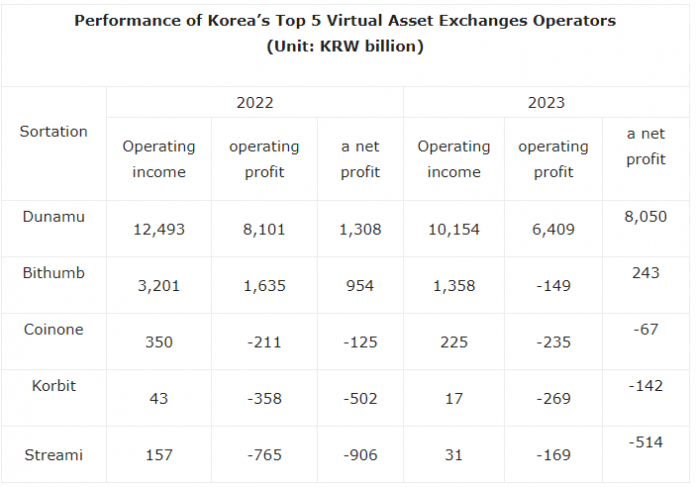

Last year, South Korean cryptocurrency exchanges generally recorded poor performances. The continued ‘crypto winter,’ marked by a contraction in investment sentiment for major cryptocurrencies including Bitcoin, led to a significant decrease in transaction volume and fee revenue. According to the electronic disclosures by the Financial Supervisory Service, the total operating revenue of the top five South Korean cryptocurrency exchanges ‘Dunamu’, ‘Bithumb Korea’, ‘Coinone’, ‘Korbit’, and ‘Streami’ was approximately 1.1785 trillion KRW, down 26.8% from the previous year. Operating profits also fell by 33.5% to 558.6 billion KRW.

Dunamu, which operates Upbit, showed relatively better performance. Although its operating revenue decreased by 18.7% to 1.0154 trillion KRW, its net income surged by 515.4% to 805 billion KRW due to the increase in the value of the digital assets it holds. On the other hand, Bithumb Korea recorded an operating loss of 14.9 billion KRW and shifted to a deficit, with its net income decreasing by 74.5% to 24.3 billion KRW. Coinone and Korbit also recorded operating losses and failed to escape deficits. Streami, despite a 96.9% increase in operating revenue to 3.1 billion KRW, suffered an operating loss of 16.9 billion KRW and a net loss of 51.4 billion KRW.

With the rise in Bitcoin prices this year, exchanges are attempting a turnaround. The average daily transaction volume in the first quarter increased nearly fourfold compared to the same period last year. Particularly, Bithumb’s daily average transaction volume increased more than sevenfold to 1.37983 billion USD, and Upbit’s volume also tripled to 429.08 million USD. This growth is closely linked to the market share among the exchanges, where those with higher shares generate more revenue. However, the performance disparity among the exchanges continues.

Thus, South Korean cryptocurrency exchanges are experiencing mixed results due to differences in market share, and it remains uncertain whether the increased trading activity due to the rise in Bitcoin prices will lead to better performances for the exchanges.