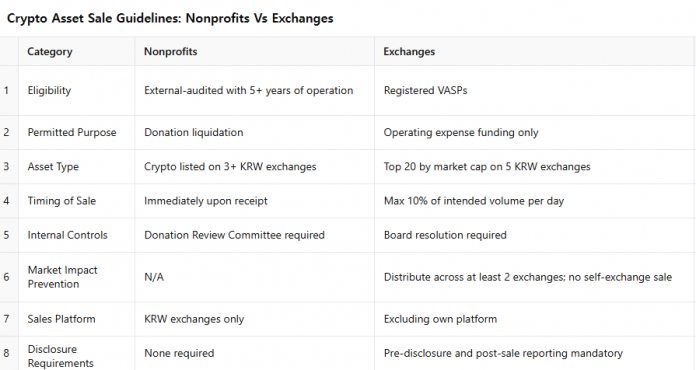

Starting in June, South Korea will allow nonprofit organizations and cryptocurrency exchanges to sell digital assets under a new set of regulatory guidelines, aiming to enhance transparency and minimize market impact.

The Financial Services Commission (FSC) finalized the guidelines as part of its broader roadmap for enabling institutional entry into the digital asset market. Under the rules:

🏛️ For Nonprofit Institutions:

-

Only external-audited entities with over 5 years of operational history can sell donated crypto.

-

A mandatory internal Donation Review Committee must pre-approve crypto use and liquidation plans.

-

Donations must consist of assets listed on at least three Korean won-based exchanges.

-

Crypto donations must be converted to fiat immediately upon receipt.

-

Only transfers via verified Korean won exchanges are permitted.

-

Strict KYC and AML protocols will be enforced.

🏦 For Cryptocurrency Exchanges:

-

Only exchanges registered as virtual asset service providers (VASPs) may sell assets.

-

Sales are allowed solely to cover operating expenses.

-

Only the top 20 crypto assets by market cap listed on 5 local exchanges are eligible.

-

Sales must be spread across at least two external exchanges, excluding the seller’s own.

-

Daily sale limits apply (max 10% of intended volume), with further caps based on average volume.

-

Price slippage is capped within ±1% of the market price.

-

Each sale must follow board approval, be pre-disclosed, and include post-sale reporting.

Additionally, a revised listing protocol will take effect from next month to address extreme price fluctuations (known as “listing pumps”) upon token launches. Exchanges will be required to secure minimum circulating supply and impose temporary market order restrictions to stabilize prices post-listing.

The FSC also plans to roll out real-name account issuance guidelines for listed corporations and certified professional investors later this year.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)