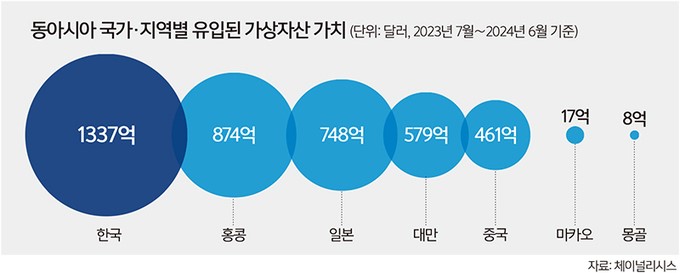

South Korea has recorded the highest inflow of virtual assets among East Asian countries over the past year, totaling 178 trillion KRW (133.7 billion USD). This figure is gaining global attention and indicates a significant increase in South Korea’s presence in major cryptocurrency trading flows.

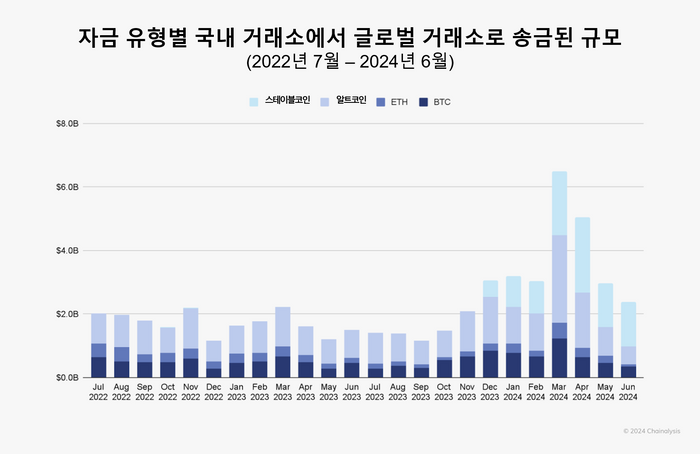

Surge in Altcoins and Stablecoins

According to a report by blockchain analytics firm Chainalysis, the inflow of virtual assets into South Korea is primarily driven by the rise in altcoin and stablecoin transactions. Altcoins refer to various cryptocurrencies other than Bitcoin, while stablecoins are digital assets pegged to real-world currencies, such as the US dollar, known for their low volatility, making them attractive to investors. South Korea has particularly excelled in trading these two types of virtual assets.

Impact of the “Kimchi Premium”

Another major factor influencing this influx is the “Kimchi Premium” phenomenon unique to South Korea, where the price of cryptocurrencies is higher than in overseas markets. This creates arbitrage opportunities, encouraging the movement of virtual assets between domestic and foreign exchanges. For instance, as of March 2024, the Kimchi Premium for Bitcoin reached as high as 18%, prompting investors to inject more funds into the South Korean market.

Influence of Global Economic Factors

Recent US interest rate cuts have also had a positive impact on the cryptocurrency market. On September 18, 2024, the US lowered its benchmark interest rate by 0.5%, increasing liquidity and pushing Bitcoin’s price upward. Interest rate cuts generally encourage capital inflow into the cryptocurrency market, and the altcoin market is also expected to remain bullish in the near future.

Dominant Role of High-Net-Worth Investors

Notably, the top 1% of high-net-worth investors account for about 70% of the total transactions in South Korea’s cryptocurrency market, highlighting the dominant role of a small number of large investors. Major exchanges like Upbit and Bithumb have a high proportion of large accounts, and these investors stand to gain significant profits during market upswings.

Future Outlook

Experts predict that the upward trend in the cryptocurrency market will continue. Expectations are high that potential further US interest rate cuts and shifts in the global financial environment will have a positive impact on the virtual asset market. In particular, Ethereum, which offers a 4% staking yield, is anticipated to enter a strong bullish phase if US Treasury yields continue to decline.