Rumors surrounding Major Exchange Platforms Bithumb and Cosmochain spread “Complex Ownership Structure” and “Quite Exaggerated value”

As the cryptocurrency price fluctuate again, the industry foresees its future cloudy. It is recommended for the investors to be cautious with the investment and the use, as the rumors related to cryptocurrency investments and M&As are repeating.

According to a source, concerns surrounding the industry is much heightened, with continuous opaque situations. The concerns are not only subjected to small-sized blockchain developers. It is also regarding large exchange platforms and developers.

Especially, recent rumor surrounding major Korean exchange platform ‘Bithumb’ are concerning investors. The stock price fluctuated in accordance with a rumor that Dual Industrial(078590) will take over the 57.41% shares of ‘BTHMB Holdings’. The 57.41% shares Dual Industrial is rumored to acquire currently belong to CEO Kim, Byeonggeon who recently trying to take over the Singaporean platform. BTHMB Holdings is focusing on helping CEO Kim to comprise a blockchain network alliance called ‘BXA’, and adding Bithumb to the alliance to be their partner and the center of the network.

This is not the first time Bithumb has had issues and rumors surrounding it. Bithumb actually has a complex ownership structure. Bithumb is currently operated by BTCKOREA.COM, and its parent company is BTC Holdings. Last year, BK Group Consortium, led by CEO Kim Byenggeon, tried to acquire BTC holdings. However, rumors spread as it seemed BK Group Consortium had a problem due to the insufficient fundraising.

Dual Industrial first appeared to be helping BK Group acquire Bithumb. However, Dual Industrial disclosed its acquisition of BTHMB Holding’s 57.41% shares, and rumors spread even further. Currently, Bithumb has announced that ‘It is not true’ to make the situation somewhat relieved. However, after the announced notice is deleted, and new assumptions are raised.

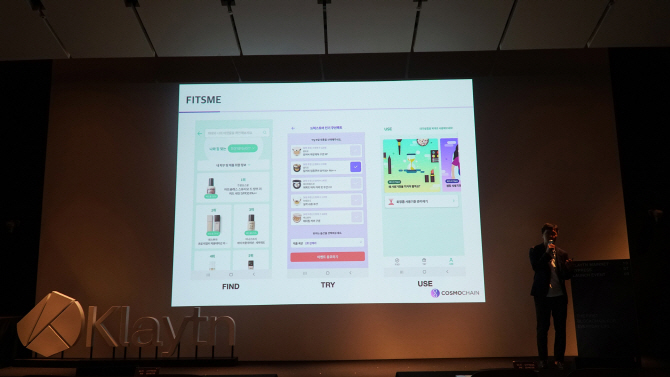

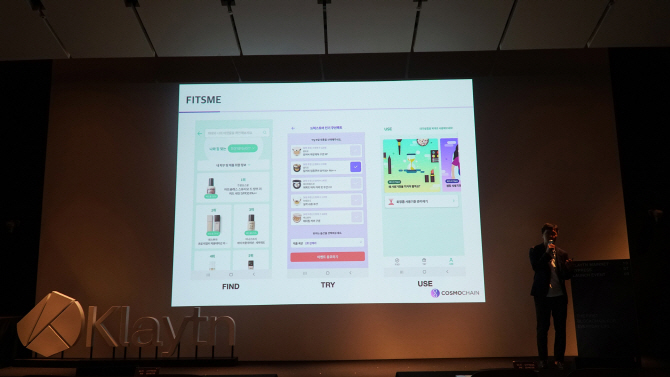

Cosmochain, a blockchain based beauty service, also recently experienced media’s attention with regard to Kakao(035720). On July. 11, a report saying Kakao Investment, an investment subsidiary of Kakao, has decided equity investment on Cosmo chain’s parent company(Blended) was released. However, shortly after the release, it was quickly withdrawn. Sources from Cosmochain did not clearly give an explanation regarding the situation and only said, “There was a communication problem”

However, it is confirmed that they are still in partnership with Kakao. Kakao has participated in the ICO of Cosmochain before, and recently is cooperating with Cosmochain for the recently launched Kakao’s blockchain ‘Klaytn’.

A source from the industry said, “Cosmochain also has announced before like there may be a special relationship going on with Samsung Electronics when their application was decided to be installed in Samsung Galaxy S10. Kakao might have felt some kind of discomfort.”

There was a similar case prior to Cosmochain last February. MOFAS has corrected their announcement on “Cooperation with Master Card”. MOFAS later explained that they confused the name with a Hong Kong credit card company. Cashierest, a cryptocurrency exchange platform, has been blamed for their comment ‘Part of the media reports are biased’ during their lawsuit with investors regarding their independent cryptocurrency.

A source from a Korean cryptocurrency exchange platform said, “The lack of domestic legal provisions led the complex ownership structures for most of the domestic companies. Investors should be fully aware of platforms’ ownership structure and press release regarding the issue.”

Lee, Jaewon (2019. 07. 15) 가격 회복하니 혼탁해지나..루머·해프닝 이어지는 암호화폐 시장

Edaily, Retrieved from https://www.edaily.co.kr/news/read?newsId=03831046622554848&mediaCodeNo=257

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-324x235.jpeg)