[Paxnet News Kim Ka-young] The market for virtual asset lending with certain coins as collateral, such as Bitcoin and Ethereum, is growing. Virtual asset lending services are being launched globally, and major virtual asset exchanges have added virtual asset services to their platform.

A virtual asset secured loan service is a service that takes a certain virtual asset as collateral and lends another virtual asset or fiat currency. In most cases, major coins like Bitcoin and Ethereum are taken as collateral. With this service, even if you don’t have the funds to invest in virtual assets right now, you can take your own coins as collateral, get a loan from the exchange to invest again, and you can get the leverage effect, so it is popular with investors. Exchanges can secure new customers by offering virtual asset lending services.

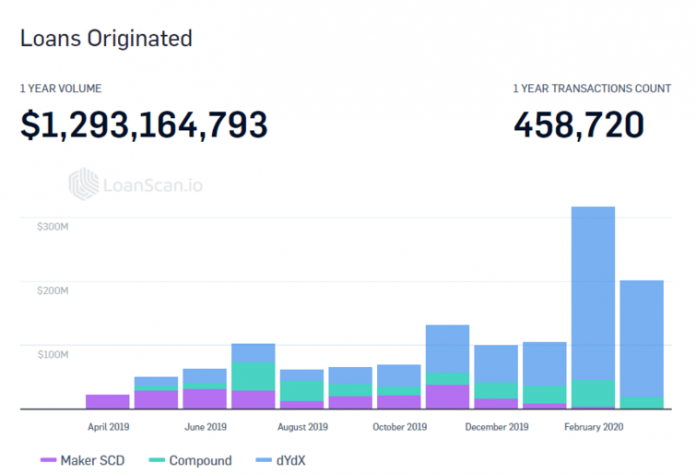

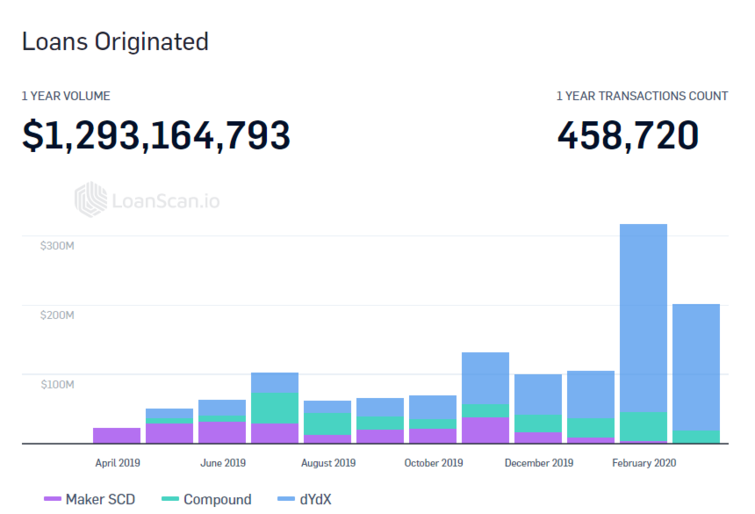

The world’s largest virtual asset lending platforms are Compound, Maker SCD and dYdX. According to ‘LoanScan’, which provides virtual asset lending data, the amount of virtual asset lending made by these three companies in the past year was about $1.29 billion (about 1.44 trillion won). In addition, the market has continued to grow since 2017, when LoanScan first began compiling the data and in February, the amount of lending increased by three times compared to January. Although the amount of lending increased during recession of the virtual asset market, it seems that more loans were taken out in the market rally during February.

The most developed region of the virtual asset lending industry is the United States. According to a report last month of Genesis Global Capital, a leading virtual asset lending company, said, “The region with the most developed virtual asset lending industry is the United States, accounting for approximately 75% of the total, and Europe and Asia accounting for approximately 25% of the total.”

As the market grows, virtual asset lending companies and exchanges collaborate to provide the services in Korea.

Most virtual asset loans are made automatically through blockchain. When the settling day is reached, the system is set up through a blockchain smart contract to automatically settle the loan from the collateral. Since the loan is made on the system without an intermediary, this type of loan is included in DeFi (Decentralized Finance), a decentralized financial service. On the other hand, if the exchange provides a lending service as an intermediary, it is the CeFi (Centralized Finance).

Lending and settlement are not automatically made like DeFi, but each exchange develops a strategy to quickly secure users. They are trying to emphasize the advantages of the CeFi.

Last month, Bithumb launched a ‘Bithumb Lending’, a virtual asset secured loan service for Bithumb members, in partnership with Delio, a virtual asset lending service provider.

Bithumb lending is a service that takes KRW as collateral and lends Bitcoin and Ethereum or takes Bitcoin and Ethereum as collateral and lends KRW or another virtual asset. In addition, Bithumb launched lending services that can make profits in both bear market and bull market.

If you borrow a virtual asset from the exchange and then sell it when the market price is high, then buy it in the bear market and repay it to the exchange, the difference will be the profit through this product. It is a product that can make a profit even with a virtual asset taken as collateral if the market price rises after borrowing the KRW as collateral for the virtual asset.

Upbit’s operator Dunamu also launched a virtual asset lending service through its subsidiary DXM. The feature of this service is that you can make loans and deposits at the same time. DXM provides deposit and lending services of KRW-based stablecoin, ‘TerraKRT’, on its own blockchain reward wallet ‘Trinito’. Users can receive interest in their wallet every hour by depositing TerraKRT into Trinito. Users can also invest in other virtual assets by borrowing TerraKRT as collateral for Bitcoin or Ethereum.

Kim Ka-young(2020.03.16) 덩치커진 가상자산 담보 대출…3배 급증

retrieved from https://paxnetnews.com/articles/58200