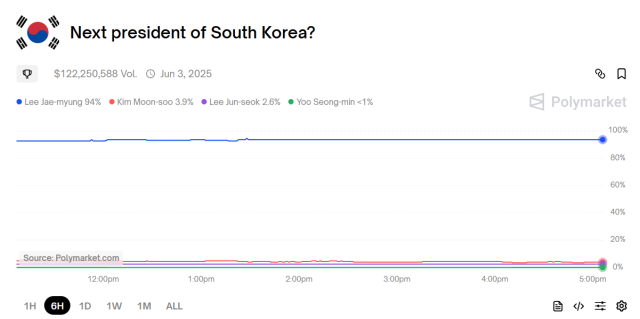

<Prediction bets on the South Korean presidential election listed on the decentralized betting platform “Polymarket.”>

As South Korea’s 2025 presidential election approaches, the decentralized prediction platform Polymarket is drawing global attention. Over $100 million has already been wagered on the outcome, signaling growing interest from both local and international participants.

Powered by the USDC stablecoin, Polymarket allows users to bet on binary questions like “Will Lee Jae-myung win?” by purchasing “Yes” or “No” shares priced between $0 and $1, depending on market sentiment. These shares settle at $1 if the prediction proves correct.

As of mid-May, Lee Jae-myung leads with a 90% implied probability, with total trades on this market exceeding $120 million. Beyond simple speculation, Polymarket has emerged as a dynamic space where public sentiment is reflected through real-time market fluctuations.

What sets the platform apart is its responsiveness. Events like news updates or changes in public schedules—such as the postponement of Lee’s trial—have had an immediate impact on trading prices, offering faster insights than traditional polling methods.

Korean users, in particular, have engaged actively, leveraging their deeper understanding of the domestic political landscape. For many, Polymarket is more than a betting venue—it’s a tool for turning information and intuition into real-time market-based predictions.

In a world where politics and blockchain, sentiment and speculation increasingly intersect, Polymarket offers a glimpse into how prediction markets could evolve as an alternative form of public opinion tracking.