A recent survey shows that over half of Korean adults have invested in cryptocurrency, and more than half of them reported making a profit. However, 1 in 5 investors experienced losses, with most issues stemming from cryptocurrency exchanges.

The Korea Financial Consumers Protection Foundation conducted the 2024 Cryptocurrency Usage Survey, targeting 2,500 adults aged 19–69 residing in major metropolitan areas. The survey assessed investment behavior, experiences with crypto-related damages, and awareness of new legal protections following the enforcement of the Virtual Asset Users Protection Act.

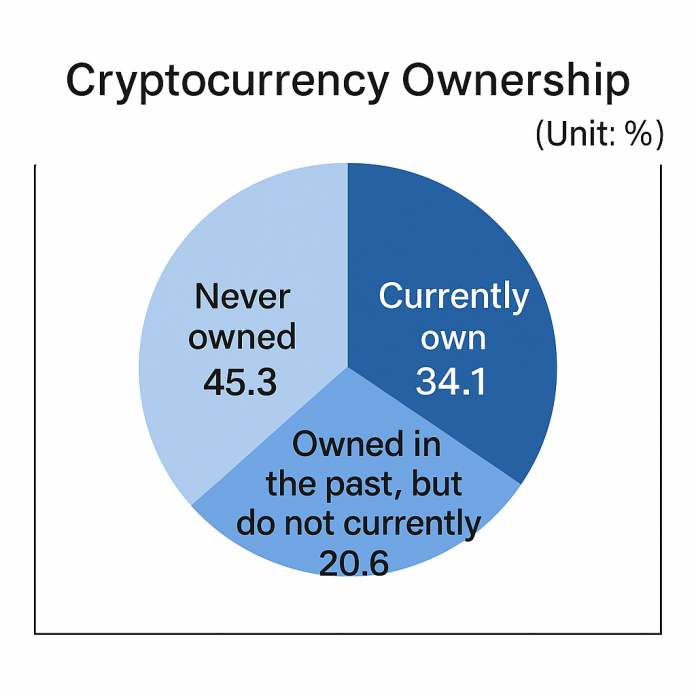

54.7% Have Held Crypto — Majority for Investment Purposes

According to the survey, 54.7% of respondents have held cryptocurrency either currently or in the past. Among them, 69.9% cited “investment” as the primary reason, followed by curiosity (42.1%), use in specific services (14.0%), and as a means of payment (13.7%).

Higher-income respondents were more likely to invest for profit. Notably, 51.6% of current crypto investors said they made profits, though most investments were under 10 million KRW (approximately $7,300), and 60.8% were short-term investments of under one year.

Top Coins: Bitcoin (76%) and Ethereum (52.8%)

On average, current investors hold three or more cryptocurrencies, with Bitcoin and Ethereum being the most common holdings. Ripple, Dogecoin, and Solana followed. Female investors leaned more toward these mainstream, stable coins, and “trading volume” was the most cited factor in choosing both exchanges and tokens (48.5% and 51.9% respectively).

20.3% Experienced Crypto-Related Losses — Exchanges Most Common Cause

Among those with crypto experience, 20.3% reported losses, with 72.8% blaming exchange-related issues such as system failures, hacking, or closures. Other common problems included misleading “investment guidance groups” (44.7%) and outright investment scams (35.5%).

Most reported losses were small (under 10 million KRW), and 67.7% took no action to recover their losses, citing reasons such as low amounts or disbelief in the possibility of compensation.

Crypto Protection Law Awareness at 63.1%, but Impact Felt by Only 1 in 4

The Virtual Asset Users Protection Act, enacted in July 2024, is recognized by 63.1% of respondents, but only 25.4% said they feel the law has made a real difference. Among those aware of the law, the most requested improvements were harsher penalties for scams (26.8%) and stronger exchange security (21.5%).

Experts Warn Against Impulsive Investing and Call for Regulatory Improvements

The Foundation emphasized that while crypto adoption is rising, many investors still pursue short-term, speculative gains and are poorly informed about the market and legal landscape.

“Investors must be cautious about misleading information and focus on acquiring reliable knowledge before making investment decisions,” said a Foundation spokesperson. They further stressed the need for policy reform to enhance exchange reliability and user protections in the evolving digital asset landscape.