Korea’s virtual asset market capitalization increased 46 percent in the first half of the year compared to the previous half-year term, driven by the rebound in cryptocurrency prices and investor sentiment.

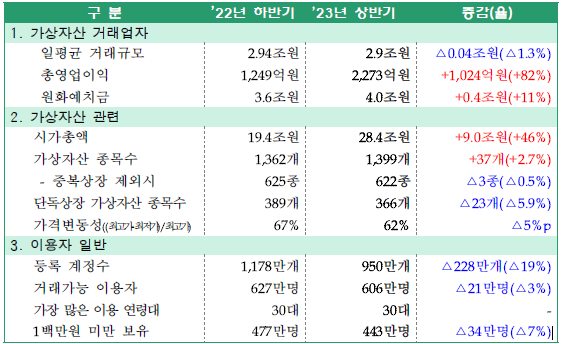

According to the Financial Services Commission (FSC) report on Monday, the virtual asset market cap in Korea reached 28.4 trillion won ($21.1 billion) in the January-June period, up 46 percent — or 9 trillion won — half-year on half-year.

During the same period, the global virtual asset market cap grew 53 percent to 154 trillion won. Bitcoin prices rose 81 percent to $30,441 as of June, compared to the end of last year.

Operating profits of virtual marketplace operators in Korea increased 82 percent to 227.3 billion won over the first six months of the year, while deposits rose by 11 percent to 4 trillion won during the same period.

The FSC surveyed a total of 35 virtual asset operators in the country, including 26 crypto exchanges.

Despite an increase in the value of the crypto market, the average value of daily crypto transactions at 26 exchanges dipped 1.3 percent to 2.9 trillion won in the January-June period from six months ago.

The number of individual and corporate crypto traders also decreased by 210,000 to 6.06 million as of the end of June.

Of the individual traders, those in their 30s accounted for the biggest share and more than 67 percent held virtual assets worth less than 500,000 won.

The data also showed that 622 types of cryptocurrency, including Bitcoin, Ethereum, Ripple and Dogecoin, were traded in Korea in the first half.

Also in the first half, a total of 169 crypto coins were newly listed, while 115 coins had a suspension of trading due to project risk, investor protection or other reasons.

The max draw-down rate of cryptocurrencies, which shows the price volatility, stood at 62 percent as of the end of June, down 5 percentage points from the end of December.

Korea plans to implement a law to protect crypto investors, the first of its kind, in July next year.

Under the new law, those who unfairly trade virtual assets can be sentenced to prison and fined. Acts of unfair trading include the use of undisclosed information, market price manipulation and illegal transactions.

SHIN HA-NEE

(2023.10.09) “Korea’s virtual asset market cap soars to $21.1 billion in H1”

retrieved from https://koreajoongangdaily.joins.com/news/2023-10-09/business/finance/Koreas-virtual-asset-market-cap-soars-to-211-billion-in-H1/1886013

![[JULY]New President, New Terms For Crypto Sector](https://coinhubkorea.com/wp-content/uploads/2025/07/ChatGPT-Image-2025년-6월-30일-오후-05_28_13-324x235.png)