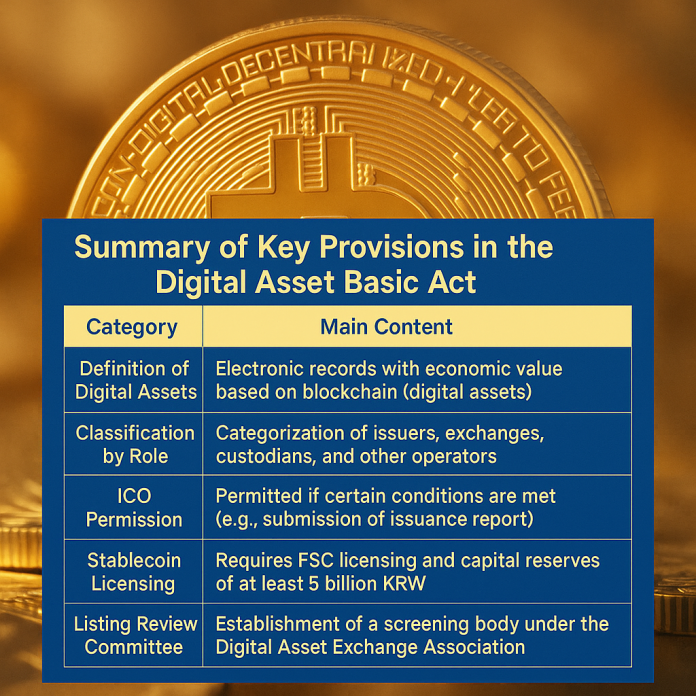

In 2025, South Korea’s regulatory landscape for digital assets is poised for a major shift. The Democratic Party is set to introduce the “Digital Asset Basic Act” to the National Assembly this week. As the country’s first unified legislation on digital assets, the bill outlines comprehensive regulations for everything from definitions and classifications to the oversight of issuers, exchanges, and custodians. The impact is expected to be profound across capital markets and financial supervisory systems.

At the center of the debate lies the regulatory framework for stablecoins, especially those pegged to the Korean won. The bill defines stablecoins as “digital assets similar to currency” and requires issuers to obtain licensing from the Financial Services Commission (FSC), hold at least 5 billion KRW in reserves, and comply with real-time reserve disclosures, secure asset custody, and quarterly reporting obligations. This effectively treats stablecoins as digital currency equivalents.

However, these conditions have raised concerns among startups and smaller players in the industry, who argue that such stringent requirements could stifle innovation. Critics warn that excessive capital thresholds may favor established financial institutions while shutting out new entrants. Others argue that the true health of a stablecoin project lies in the structure and transparency of its collateral system, not its cash reserves alone.

On the other hand, experts say that stablecoins must meet a minimum trust standard, especially given their potential to function like digital money. Lee Jeong-yeop, president of the Korea Blockchain Law Society, commented, “If a project can’t meet a 5 billion KRW threshold, it may pose significant risks to users, including insolvency or fraud.”

The bill also includes provisions to legalize initial coin offerings (ICOs), establish a centralized listing review committee for exchanges, and create a new independent “Digital Asset Committee” under the FSC. This committee will oversee policy design, market surveillance, and promotional strategies, likely serving as a central platform for future crypto-related governance.

With the National Assembly’s Policy Committee expected to begin discussions in June, the legislative outcome could become a turning point for Korea’s digital asset ecosystem—and potentially reshape the country’s position in the global financial future.