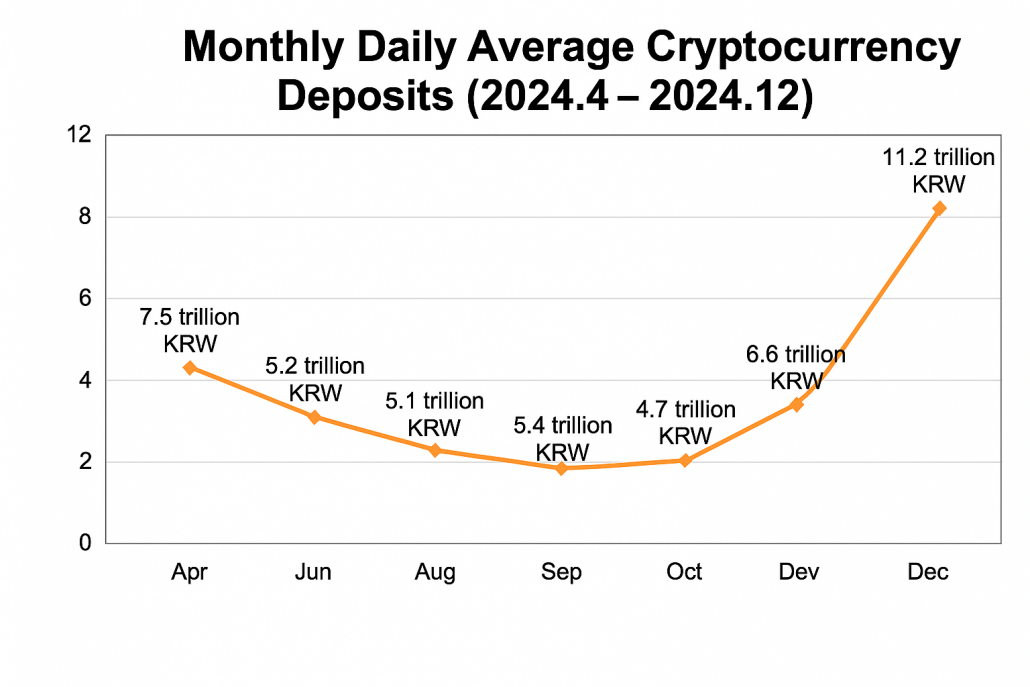

South Korea’s cryptocurrency market is experiencing explosive growth, with the number of investors approaching 10 million. According to a recent survey by the Financial Intelligence Unit (FIU), the total market capitalization of digital assets in the country reached 107.7 trillion KRW by the end of 2024 — a 91% increase from just six months earlier. Daily trading volume also rose by 22%, hitting 7.3 trillion KRW. Meanwhile, user deposits in fiat (KRW) doubled to 10.7 trillion KRW, and operating profits increased 28% to 741.5 billion KRW.

The number of registered crypto exchange accounts hit 20 million, while 9.7 million users were identified as active traders. Investors in their 30s represented the largest demographic at 29%, followed by those in their 40s and 20s. Although 66% of users held less than 500,000 KRW, 12% were high-net-worth investors with over 10 million KRW in assets — a segment that continues to grow.

The boom has been largely driven by KRW-based exchanges, which saw robust performance across all indicators. In contrast, coin-to-coin markets (non-fiat exchanges) suffered setbacks, with average daily trading volumes plummeting by 81%. The gap between fiat-based and crypto-based exchanges has widened significantly.

The number of listed digital assets rose to 1,357, including 287 tokens that were listed exclusively on a single exchange. Many of these were low-cap and high-risk, with over a third valued at under 100 million KRW. While the number of new listings decreased, delistings also dropped by more than half, suggesting gradual market stabilization.

Meanwhile, custodial service providers saw a sharp decline. Their total asset holdings shrank by 89% to 1.5 trillion KRW, and the number of users fell 99% to just over 1,100. This points to an ongoing shift away from retail usage and toward institution-driven market activity.

The market’s dramatic expansion was fueled in part by the U.S. approval of spot Bitcoin ETFs and the inauguration of a crypto-friendly Trump administration. Domestically, the enforcement of the Virtual Asset User Protection Act in July also helped bolster investor confidence and accelerate institutionalization.