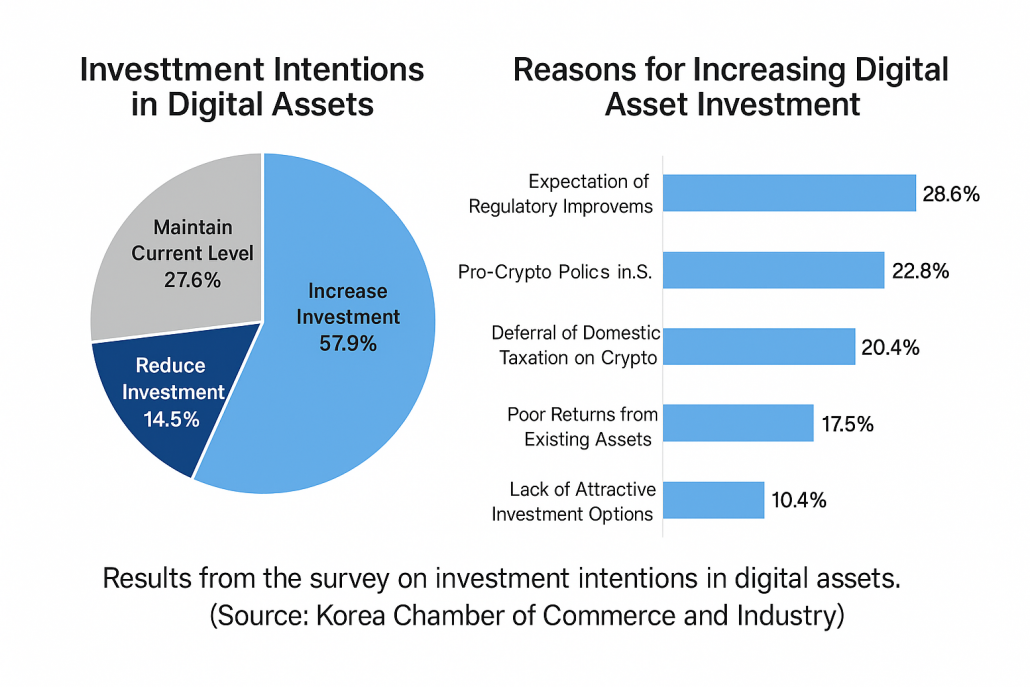

South Koreans are increasingly optimistic about the future of digital assets, with nearly six in ten saying they plan to increase their investments. According to a recent survey conducted by the Korea Chamber of Commerce and Industry (KCCI), 57.9% of respondents indicated they would expand their digital asset holdings, citing growing confidence in upcoming regulatory frameworks and global policy trends.

The most frequently cited reason for planned investment was expectation of legal and institutional improvements (28.6%), followed by pro-crypto policies in the U.S. (22.6%), Korea’s deferral of digital asset taxation (20.4%), and dissatisfaction with returns from traditional asset classes (17.5%). Investors appear to be looking beyond conventional financial markets and exploring new asset classes for diversification and growth.

From Investment Vehicles to Economic Drivers

A significant 78.2% of survey participants believe digital assets will positively impact the Korean economy. Key benefits highlighted included new industry and job creation (28.2%), financial innovation (24.6%), relief from real estate-driven investment concentration (20.4%), and enhancing Korea’s global financial competitiveness (12.8%). This shift reflects a growing perception that digital assets are more than speculative tools—they’re potential engines of economic innovation.

Public sentiment also leans in favor of easing regulations. 58.4% supported regulatory relaxation, while 41.6% favored stronger oversight. Those advocating for lighter rules cited benefits such as improved access to capital (52.9%), global competitiveness (25.4%), and industrial advancement (17.1%). In contrast, proponents of tighter regulations emphasized the need to protect investors and stabilize the market.

Policy Priorities: Law First, Then ETFs

When asked about policy priorities, the majority of respondents pointed to the enactment of a comprehensive Digital Asset Basic Act (26.3%) as the most urgent need. Other top priorities included the launch of spot ETFs (20.9%), establishing a regulatory framework for stablecoins (15.6%), legislation for tokenized securities (13.6%), clarifying taxation rules (13.0%), and allowing institutional investment (10.5%).

This suggests that investors are looking beyond hype or short-term gains and are instead focused on building a trustworthy and structured ecosystem for digital assets.