South Korea’s Security Token Offering (STO) market is approaching a major turning point, driven by ongoing legislative efforts and aggressive ecosystem building by leading financial institutions. With the government aiming to formalize STO legalization by the second half of the year, private firms are racing to develop platforms and alliances to secure a competitive edge.

The Financial Services Commission has fast-tracked amendments to the Capital Markets Act and the Electronic Securities Act, aiming for parliamentary approval by July or August. The government’s stated goal is to launch a full-scale STO issuance, distribution, and custody market by the end of 2025, giving the private sector strong incentive to prepare infrastructure in advance.

In response, major players such as Mirae Asset, Hana, SK, Samsung, and KB are actively forming consortia or developing their own STO platforms. For instance, Hana Securities is partnering with BuySellStandard, while LS Securities has joined forces with HighKive to tokenize real-world assets (RWAs) like real estate and luxury goods.

Notable progress is also being made by companies such as Kasa, Funble, LucentBlock, and Vibric, which are pioneering STO applications in sectors including real estate, music rights, and agricultural products like premium beef. Their efforts to conduct public offerings via STOs are transforming tokenized assets into viable investment products.

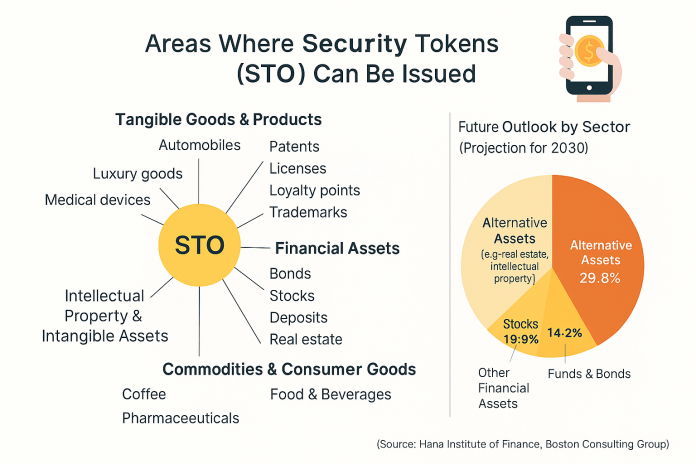

Market research firms and financial think tanks are also expressing optimism. According to BCG and the Hana Institute of Finance, Korea’s STO market is projected to grow from ₩34 trillion in 2024 to ₩367 trillion by 2030. Analysts say this signals not just digitization of assets but a fundamental restructuring of traditional finance.

Industry insiders stress that the current phase represents a “now-or-never” opportunity. “If companies don’t prepare now, barriers to entry will rise significantly after legalization,” one official noted. “Early adoption and parallel legal-tech readiness are key.”

With regulatory groundwork being laid and institutional players actively engaging, South Korea’s STO market appears poised to evolve into a next-generation financial ecosystem. The upcoming summer session in the National Assembly could prove to be the critical juncture shaping its trajectory.