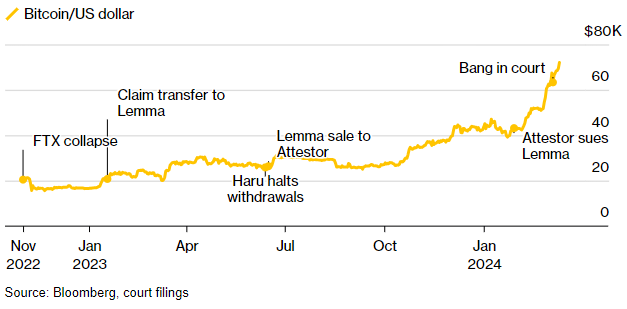

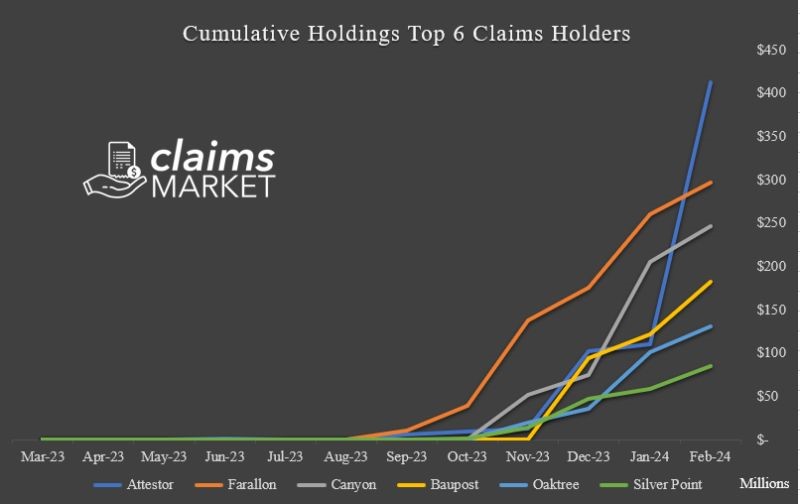

The UK hedge fund Attestor is embroiled in a legal battle to recover its investment in FTX bankruptcy claims, but the involvement of Korean firm B&S Holdings has added a major complication. Last year, Attestor acquired around $400 million worth of FTX customer account claims from Panamanian company Lemma Technologies. However, as cryptocurrency prices rebounded, driving the value of those claims up to $165 million, Lemma attempted to back out of the deal, leading to the dispute.

Attestor sued Lemma in a New York court for “clear seller’s remorse,” while Lemma has yet to officially respond, setting the stage for a protracted legal fight between the two firms. The situation took a new twist with the revelation that Junho Bang, Lemma’s key investor, is the majority shareholder of B&S Holdings. Bang was recently indicted in South Korea for allegedly misappropriating around $600 million from crypto lender Haru Invest.

Industry experts warn that the B&S Holdings connection has taken the FTX claims dispute into uncharted territory. “Beyond just Lemma, the B&S Holdings link has escalated the uncertainty and complexity around distressed crypto exchange investment,” one analyst noted. Unlike traditional bankruptcy claims on company debt, acquiring claims on individual customer accounts at crypto exchanges carries unique legal risks, as this case highlights.

While cryptocurrencies have rebounded lately, investor confidence remains shaken post-FTX, and this dispute could be a litmus test, according to Reuters: “The nascent crypto claims market still lacks a robust legal foundation, and all eyes are on the Attestor-Lemma battle.” The Wall Street Journal echoed that view: “Crypto bankruptcy claims are a new frontier fraught with risks illustrated by the Attestor-Lemma showdown over murkier individual account holdings.”

As the legal tussle drags on, its resolution could have far-reaching implications for future distressed crypto investment and reshape the emerging landscape.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)