As expectations for digital asset legalization grow stronger both in South Korea and globally, more Korean publicly listed companies are moving to acquire Bitcoin as part of their strategic asset portfolios.

According to recent disclosures from the Financial Supervisory Service’s DART system, major Korean companies now collectively hold over 679.34 BTC, valued at approximately KRW 99 billion (USD 71 million). This marks a significant shift from previous years, where crypto was widely seen as a speculative or even risky investment.

BitMax, a domestic cryptocurrency exchange operator, leads the pack with 251 BTC in holdings. The company recently announced plans to issue KRW 100 billion (USD 72 million) in convertible bonds, allocating up to 90% of the proceeds for Bitcoin purchases. This move closely mirrors the strategy of U.S.-based MicroStrategy, known for aggressively accumulating Bitcoin as a treasury asset.

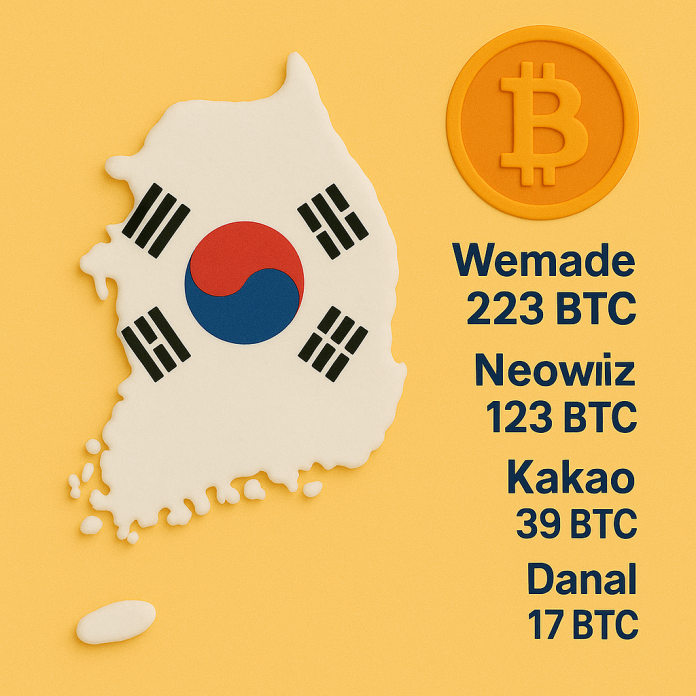

Other notable holders include:

-

Wemade – 223 BTC

-

Neowiz – 123 BTC

-

Kakao – 39 BTC

-

Celltrion – 18 BTC

-

Danal – 17 BTC

-

Netmarble – 8.29 BTC

The surge in corporate Bitcoin acquisition is driven by multiple factors:

-

The rise of Bitcoin ETF products in the U.S.

-

Growing expectations for legal reforms in South Korea, such as allowing corporate real-name accounts at crypto exchanges

-

Shifting perception of Bitcoin as a long-term store of value rather than a speculative asset

Industry analysts suggest that this is only the beginning of broader institutional adoption. “Bitcoin is no longer just a retail phenomenon,” one market observer noted. “Korean companies are starting to see Bitcoin as a viable hedge and a reserve asset – in line with global trends.”

With upcoming legislation potentially opening the doors for greater corporate participation in crypto markets, South Korea’s business landscape may soon mirror institutional investment movements seen in the U.S. and Europe.