After about four years, the domestic cryptocurrency exchange Korbit has regained its position as the third-largest exchange by overtaking Coinone in trading volume. This shift comes as Korbit aggressively adopts a new listing strategy alongside a no-fee policy, drawing industry focus on whether this approach will further increase its market share and cement its standing.

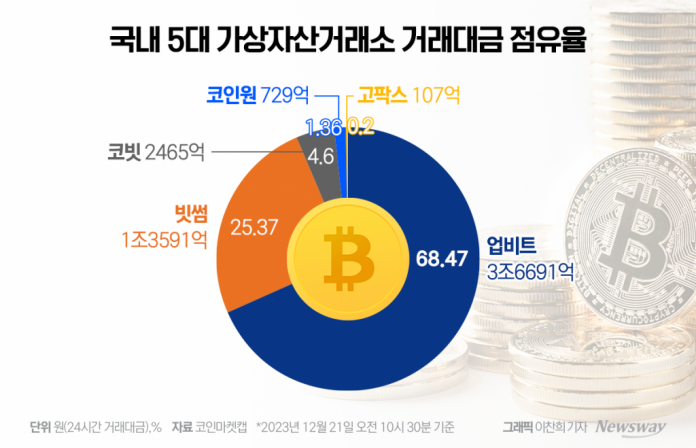

Korbit has recently expanded its asset offerings by listing various cryptocurrencies, including HVH, ISK, ASTR, NMR, and GLMR. This move follows the relisting of WEMIX, which was delisted by DAXA last year, marking a more aggressive listing strategy since the elimination of trading fees last October. As a result, Korbit’s market share has climbed to 1.93%, surpassing Coinone and widening the gap with a current share of 5%.

Since its inception in 2013, Korbit has maintained a conservative listing policy, which was positively regarded by NXC, the Nexon holding company, when it acquired Korbit in 2017. Major shareholders like NXC and SK Square have continued this conservative approach, valuing corporate social responsibility. However, Korbit’s recent proactive listing policy corresponds with the market’s bullish sentiment, with the industry buoyed by expectations for the approval of Bitcoin ETFs, the upcoming halving event, and potential interest rate cuts, leading to Bitcoin reaching its all-time high price of $43,785 according to CoinMarketCap.

Nonetheless, Korbit faces ongoing challenges in expanding its market influence. The recent surge in market share heavily depended on the relisting of WEMIX and the free trading policy, with a substantial 20-percentage point difference from Bithumb. Industry insiders suggest that if investors see value in Korbit’s trading environment, the exchange’s volume could continue to rise, with future strategies becoming a key factor. Korbit plans to continue these promotions until early next year while closely monitoring the market situation.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-324x235.jpeg)