South Korea-based crypto exchange Korbit has officially partnered with Shinhan Bank to launch virtual asset management services tailored for nonprofit organizations, entering the corporate virtual asset market alongside major exchanges Upbit and Bithumb.

The initiative marks a major milestone, with the Nexon Foundation becoming the first nonprofit organization to complete service integration with Korbit. Other charitable organizations, including The Beautiful Foundation and World Vision Korea, are also preparing to receive crypto donations through the platform. This move opens the door for donors to easily contribute using cryptocurrencies like Bitcoin.

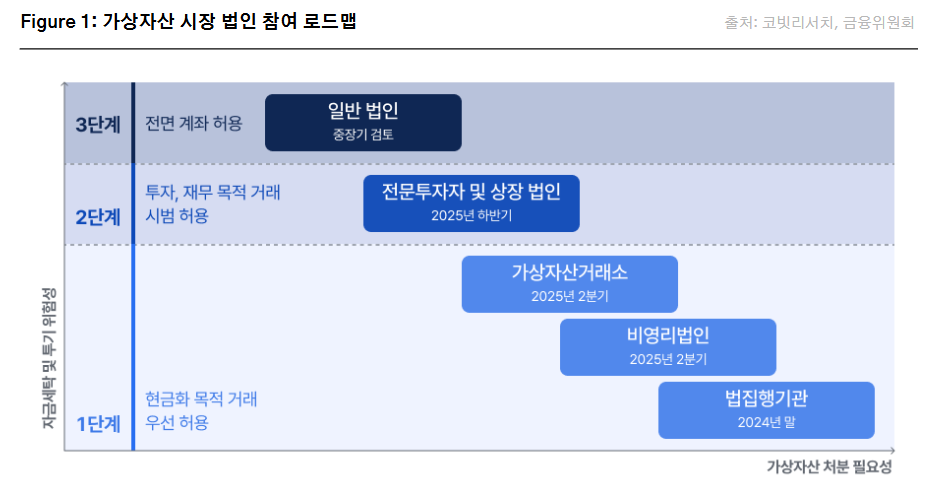

This development follows the Financial Services Commission’s February announcement of a roadmap allowing corporate entities, including nonprofits, to participate in the virtual asset market. Beginning in Q2, nonprofit organizations are permitted to obtain real-name accounts and gradually engage in selling digital assets, paving the way for a modernized and transparent donation ecosystem.

Through its partnership with Shinhan Bank, Korbit plans to provide nonprofits with secure and user-friendly digital asset management solutions based on real-name accounts. The exchange emphasized its commitment to building a healthy crypto ecosystem and promoting innovation in the donation culture.

<Provided by Korbit Research>

Meanwhile, the Korbit Research Center has published a new report titled “Bitcoin as a Corporate Asset: From Holding Strategies to Business Models,” offering strategic insights into institutional participation in the crypto market. The report, based on case studies such as Coinbase, underlines the need for enhanced regulatory capacity, tailored services for institutional clients, and diversified revenue models. It also highlights that corporations with substantial assets, strong cash flow, and active investment profiles are more likely to engage in crypto investment.

Although corporate involvement in the virtual asset market is still in its early stages, Korbit’s proactive approach positions it as a key player in shaping the next phase of institutional crypto adoption.