The cryptocurrency exchange Korbit’s cash is shrinking rapidly. If the deficit continues as in the past year, all the cash you have will run out.

According to the published Korbit audit report, Korbit’s cash holdings have fallen to 1/10 levels in two years. At the same time, the company’s cash, excluding customer deposits, was also significantly reduced.

Korbit’s cash reserves have continued to decline. In 2017, Korbit’s cash holdings were USD 251.5M, of which Korbit’s cash, excluding customer deposits, was USD 39.5M. In 2018, we had a total of USD 42.7M in cash, with approximately 4.5M in Korbit.

The decline in cash holdings continued last year. Korbit owned only USD 1.1M of cash, excluding customer deposits, of USD 22.5M. Starting in 2017, cash owned by the company is rapidly depleting.

Korbit’s decline in cash reserves is closely related to its decline in earnings. In the cryptocurrency exchange, the customer deposits the amount and the transaction is made through the deposited amount, so the more the deposit, the more active the transaction and the higher the commission income from the transaction. In 2018, Korbit’s customer deposits decreased from USD 209.1M to USD 38.2M in 2018 and USD 21.5M last year.

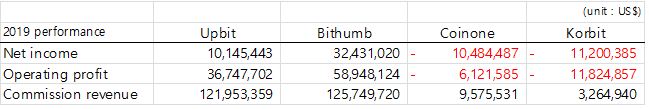

As customer deposits decreased, transactions decreased and management performance such as commission revenues deteriorated. Commission revenues, which amounted to USD 61.7M in 2017, fell to USD 21.6M in 2018 and fell to USD 2.9M last year.