To address the long-standing issue of ‘listing fees’ in the virtual asset industry, regulatory improvements have been made. The Financial Services Commission and the Financial Intelligence Unit have amended relevant laws to enable the direct revocation of business registration for virtual asset exchange operators engaged in the practice of receiving so-called ‘listing fees’ in exchange for listing coins.

According to the amended ‘Enforcement Decree of Specific Financial Transactions Information Act,’ the Director of the Financial Intelligence Unit now has the authority to revoke business registration if a virtual asset exchange receives or gives money or property of value from or to others in an illegitimate manner in connection with its operations. Listing fee collection is a typical case falling under this provision. Additionally, failure to comply with business suspension measures under the ‘Virtual Asset User Protection Act,’ which will be enforced from July next year, will also make exchanges subject to mandatory revocation.

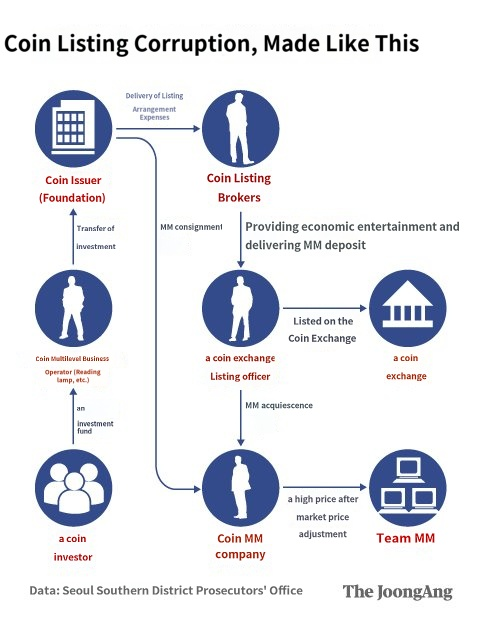

In the past, employees responsible for listing reviews at domestic virtual asset exchanges indiscriminately listed projects in exchange for bribes. This led to market manipulation, resulting in significant losses for individual investors. Currently, some former and current executives of exchanges are under investigation or trial for listing irregularities. For instance, former executives and listing team leaders of Coinone were sentenced to imprisonment in the first and second trials for accepting bribes for listings, while former CEOs of Bithumb Holdings and professional golfer Ahn Sung-hyun are also facing trials on related charges.

Although the collection of listing fees has been criticized as a chronic problem in the operation of virtual asset exchanges, exchanges themselves did not face legal penalties in the past. Only individual employees were held accountable, with no sanctions imposed at the exchange level. With this law amendment, exchanges that receive listing fees can now face direct sanctions through the revocation of business registration.

A financial authority official emphasized, “Effective responses are now possible through the direct revocation of business registration for virtual asset operators who unlawfully receive money through listing fees,” highlighting its contribution to crime prevention and the establishment of a healthy virtual asset market order.

Some exchanges have proactively prepared for the introduction of this decree. Coinone and others have embarked on measures to overhaul the listing process and strengthen internal controls to eradicate ‘listing fees.’ Choi Myung-hoon, CEO of Coinone, stated, “We will establish measures to prevent recurrence, such as instituting systems, procedures, and internal controls.”

Furthermore, financial authorities are preparing common guidelines for listing procedures to address variations in listing standards among exchanges. A virtual asset industry insider commented, “Once the common guidelines being prepared by the Financial Services Commission’s task force are released, it will become increasingly difficult for exchanges to list projects at their discretion.”

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)