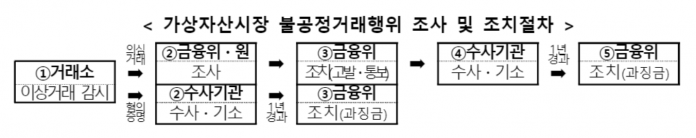

The financial authorities have decided to introduce a new “Fast-Track” system that allows for immediate referral to investigative agencies without the need for a decision from the Financial Services Commission to quickly respond to unfair trading in the cryptocurrency market. This aims to enhance the transparency of the virtual asset market and protect investors.

The Financial Services Commission will establish and publicly review the “Virtual Asset Market Investigation Business Regulations,” designed to strictly respond to unfair trading practices in the virtual asset market.

Unfair trading practices in the virtual asset market, such as market manipulation, the use of undisclosed material information, and fraudulent trading, are strictly prohibited. Violations can result in criminal penalties or fines. Violators may face at least one year of imprisonment or a fine of three to five times the amount of unfair profit, in addition to a fine of up to twice the amount of the unfair gain.

Furthermore, virtual asset exchanges must constantly monitor for suspicious transactions, and the Financial Services Commission and the Financial Supervisory Service will establish a system to investigate suspected transactions and notify investigative agencies. These measures are designed to effectively block unfair trading practices in the virtual asset market.

In addition, to effectively regulate unfair trading practices in the virtual asset market, the financial authorities will also establish a “Virtual Asset Market Investigation Agency Council” and a “Virtual Asset Market Investigation Deliberation Committee” for organic consultation on investigation policies, joint investigations, and task division among related organizations such as the Financial Services Commission, the Financial Supervisory Service, and the prosecution.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)