A widening generational gap is reshaping investment strategies among Korea’s wealthy. While the older 50s and 60s generation (“Old-rich”) are seeking safety in gold, bonds, and term deposits, younger high-net-worth individuals in their 30s and 40s (“Young-rich”) are actively investing in overseas stocks and cryptocurrencies, signaling a major shift in wealth management priorities.

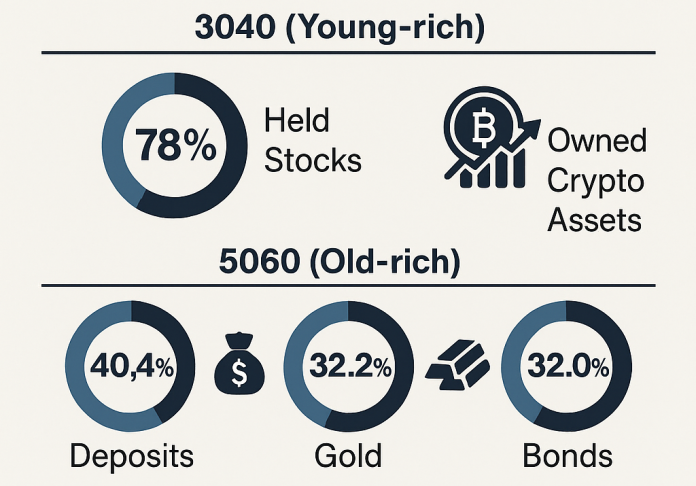

According to the “2025 Korea Wealth Report” published by Hana Bank, 75% of surveyed wealthy individuals expected the economy to worsen. In response, the top asset choices among 10-billion-won-plus investors were deposits (40.4%), gold (32.2%), and bonds (32.0%). Real estate, once a favored asset, ranked only 8th in investment preference.

In contrast, the younger generation showed a strong appetite for risk. About 78% of the 3040 generation held stocks, and nearly 30% owned crypto assets—three times more than their older counterparts. Many young professionals began investing as early as their university years or even in high school, with cryptocurrencies increasingly viewed as a growth sector rather than speculation.

While the Old-rich are gradually increasing allocations to stable assets ahead of retirement, the Young-rich are building portfolios that aim for higher returns through diversified digital and global investments. Notably, over 34% of crypto holders in the 3040 segment owned four or more types of virtual assets and preferred dollar-cost averaging over lump-sum investments.

Experts suggest that this trend could mark a structural turning point. “If the wealthy are investing in crypto not as speculation, but as a strategic long-term allocation, it may signal mainstream adoption,” noted Hana Bank researchers.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)