Starting this year, the inspection and reporting system for domestic cryptocurrency exchanges will be strengthened, and ineligible cryptocurrency exchanges will be expelled from the market. The Financial Intelligence Unit (FIU) has announced its ‘2024 Action Plan’, which includes a large-scale renewal reporting process for cryptocurrency exchanges. This process involves a comprehensive review that takes into account the risk of money laundering, the capacity to operate in the fiat currency market, and user protection. The FIU is also considering the introduction of a preemptive transaction suspension system to quickly prevent the concealment of criminal proceeds.

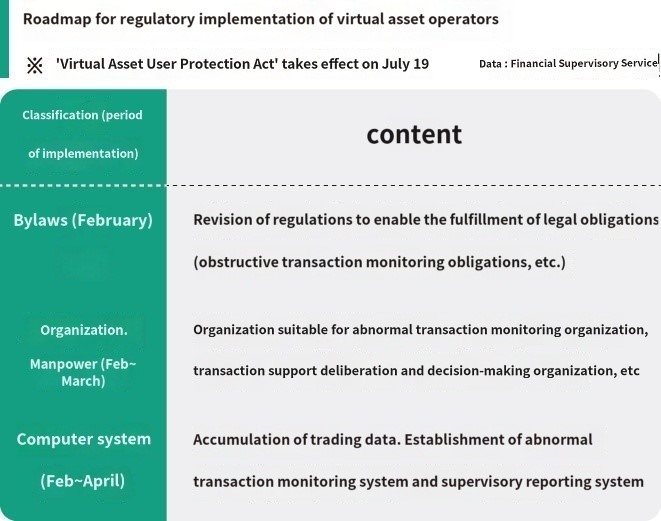

With the Cryptocurrency User Protection Law set to be implemented in July, cryptocurrency operators will be required to immediately comply with legal obligations, including the protection of user assets and the monitoring of abnormal transactions. In response, the Financial Services Commission plans to announce the establishment of ‘Cryptocurrency Investigation Regulations’, and the Financial Supervisory Service is preparing a regulatory compliance roadmap to provide on-site consulting for operators. They will also conduct readiness checks for each operator through abnormal transaction detection simulations.

Major domestic cryptocurrency exchanges are already strengthening their systems for monitoring abnormal transactions, using artificial intelligence (AI) technology to operate real-time Financial Transaction Detection Systems (FDS) that block cryptocurrency-related crimes. Exchanges like Upbit, Bithumb, Coinone, and Korbit have each developed their methods for detecting abnormal transactions and preventing money laundering, thereby protecting a significant amount of user assets from criminal damage.

These measures are enhancing the transparency and safety of the cryptocurrency market and strengthening user protection. The thorough inspection and strengthened reporting system for cryptocurrency exchanges, preparation for compliance with legal obligations, and the development of abnormal transaction monitoring systems are crucial steps in increasing the trustworthiness of the domestic cryptocurrency market.