The Financial Supervisory Service (FSS) is intensifying its preparation efforts to ensure the successful adoption of the ‘Virtual Asset User Protection Law’, set to be implemented on July 19th. This law aims to protect the assets of virtual asset users and regulate unfair trading, reflecting the financial authorities’ commitment to fostering a healthy development of the virtual asset market.

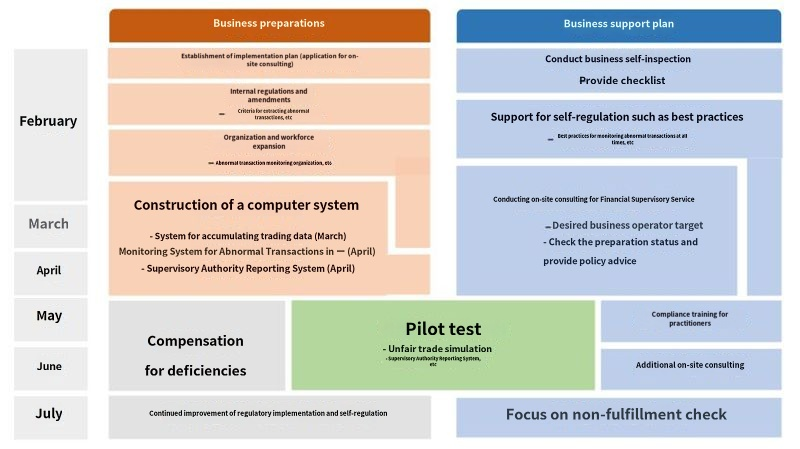

During the ‘2024 Digital Finance Supervision Work Briefing’ held at the FSS main office in Yeouido, Seoul, Kim Byung-chil, the Vice Chairman of Strategy and Supervision at the FSS, urged virtual asset operators to prepare thoroughly for the law’s implementation without delay, according to the roadmap provided. This includes establishing systems for monitoring unusual transactions and internal controls. To support this, the FSS plans to offer active assistance through on-site consulting and the development of an efficient supervision, inspection, and investigation system.

The FSS has outlined three main focuses for the law’s implementation preparation. Firstly, it aims to establish a regulatory framework, laying the foundation for operators to comply with laws and regulations through measures such as presenting roadmaps, supporting self-inspections, conducting on-site consulting, and undergoing regulatory trial applications. Additionally, the FSS intends to promote a healthy market order by creating customized supervision plans that reflect the unique characteristics of the virtual asset market, establishing continuous monitoring systems, and preparing renewal report examination plans in consultation with the Financial Intelligence Unit (FIU).

Furthermore, to eradicate illegal activities associated with virtual asset transactions, the FSS will build infrastructure, including investigative systems and regulations, and expand the existing virtual asset-related investment fraud reporting center into an integrated window for reporting unfair trading and investment scams. Proactive monitoring and rapid investigation of urgent and significant cases will be conducted to take strict measures upon discovering illegal elements.

Moreover, the FSS is committed to enhancing communication with financial companies and virtual asset operators and supports the establishment of the Virtual Asset Basic Law (the second phase of legislation). In line with digital financial innovation, the FSS will collaborate with the industry and relevant institutions to leverage the potential of generative artificial intelligence (AI) in finance, aiming to enhance financial AI competitiveness through the operation of the ‘Financial AI Data Library’ and promoting data combination and utilization based on its operational outcomes.

This initiative reflects the FSS’s determination to protect virtual asset users and ensure the market’s healthy development. After the law’s implementation, the FSS plans to focus on compliance checks and strictly deal with illegal activities such as unfair trading. Through cooperation and continuous communication with market participants, the FSS seeks to successfully establish the Virtual Asset User Protection Law and promote the sound development of digital finance.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-100x70.jpeg)