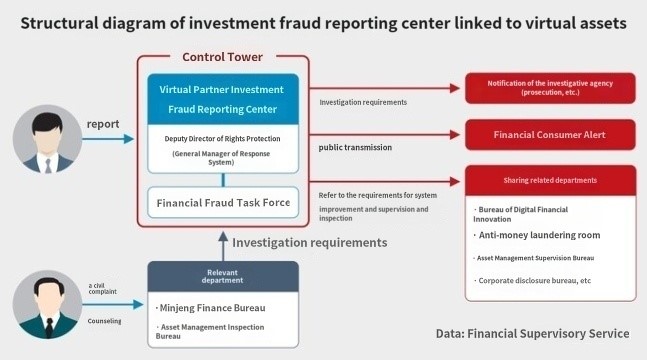

The Financial Supervisory Service (FSS) has announced the restructuring of its existing investment fraud reporting center into the ‘Virtual Asset Unfair Trade and Investment Fraud Reporting Center.’ This move is a preemptive measure in anticipation of the upcoming Virtual Asset User Protection Law, set to be implemented in July. The restructuring aims to comprehensively address not only investment fraud but also various types of unfair trading activities associated with virtual assets.

According to the FSS, a total of 1504 cases of investment fraud linked to virtual assets were reported from June to December last year, averaging about 215 cases per month. The types of fraud reported include guaranteed profits, false advertising, business viability doubts, phishing, employee impersonation, and others.

In response to the increasing sophistication and cunning nature of virtual asset-related crimes, the FSS plans to establish a systematic and proactive response system. Particularly under the Virtual Asset User Protection Law, the FSS will rigorously investigate and penalize unfair trading practices such as the use of undisclosed information, market manipulation, and fraudulent transactions.

The revamped reporting center will refine its intake system, allowing reporters to select the type of unfair trade and provide more detailed information in their reports. This collected data will be stored in a database and utilized as investigational leads after the enactment of the law. Furthermore, cases with specific and significant legal violations will be promptly forwarded to law enforcement authorities.

The FSS emphasizes its commitment to actively combat various illegal activities that disrupt the virtual asset market and to thoroughly prepare for prompt investigations and strict actions against unfair trading practices following the implementation of the Virtual Asset User Protection Law.