The Financial Intelligence Unit (FIU) conducted a survey on the state of the domestic virtual asset market targeting 29 registered businesses in the second half of 2023. The survey, which took place from July 1 to December 31, 2023, confirmed increases in trading volume, market capitalization, operating profit, and Korean won deposits compared to the first half of the year, driven by rising virtual asset prices and a recovery in investment sentiment.

As of the end of last year, the domestic virtual asset market capitalization stood at 43.6 trillion KRW, an increase of 15.2 trillion KRW (53%) from 28.4 trillion KRW at the end of June 2023. This growth rate outpaced the global virtual asset market capitalization, which grew by 39% from 1,540 trillion KRW to 2,143 trillion KRW over the same period. The Korean won market capitalization was 43.1 trillion KRW (99%), while the coin market capitalization was 460 billion KRW (1%).

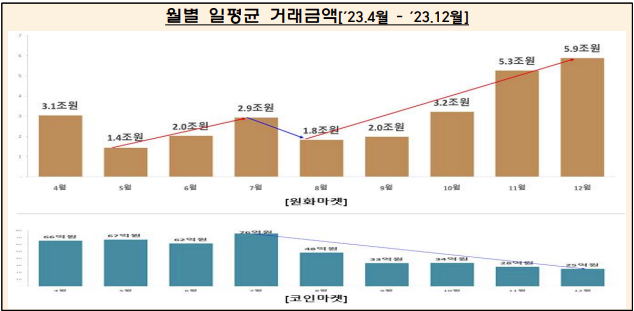

Preferences for top domestic virtual assets such as Bitcoin (BTC), Ripple (XRP), Ethereum (ETH), Dogecoin (DOGE), Solana (SOL), and Cardano (ADA), which are also among the top 10 global virtual assets, remained consistent. The average daily trading volume of 22 trading operators in the second half of last year was 3.6 trillion KRW, a 24% increase from the first half. The Korean won market trading volume was 3.58 trillion KRW, up 24%, whereas the coin market trading volume decreased by 44% to 41 billion KRW.

User deposits in Korean won, representing idle trading funds, increased by 900 billion KRW (21%) to 4.9 trillion KRW as of the end of last year compared to the end of June 2023. The average trading fee rate for virtual asset transactions remained at 0.15%, with the Korean won market at 0.18% and the coin market at 0.14%. The transaction volume of seven businesses that implemented a zero-fee policy during the second half amounted to 148 trillion KRW, accounting for 23% of the total transaction volume of all businesses.

Operating profit was 269.3 billion KRW, an 18% increase from the first half. The Korean won market recorded a profit of 296.8 billion KRW, while the coin market reported a loss of 27.5 billion KRW. There were 15 businesses in a state of complete capital erosion, and two businesses ceased operations by the end of last year after being in complete capital erosion at the end of the first half. The number of employees at trading operators totaled 1,665, a decrease of 250 from the end of the first half.

As of the end of last year, there were 1,333 virtual assets in the domestic market, a decrease of 66 from the first half. There were 332 virtual assets traded only by a single domestic operator, with 133 of these being domestic assets, a decrease of 50 from the first half. The market capitalization of these exclusively listed domestic assets increased by 27% to 1.9 trillion KRW.

The most common age group of users was in their 30s, representing 29.3% of the total. Most users held less than 500,000 KRW. The FIU advised, “The volatility of virtual asset prices remains high, necessitating cautious investment decisions.”