Cryptocurrency information required in financial statements’ commentary

Companies that either hold digital assets or have issued cryptocurrencies will be obligated to start disclosing such information publicly next year. Detailed information ― including the amount, expected financial value and business models using the cryptocurrencies held or issued by companies ― shall be written down in the commentary section of their financial statements.

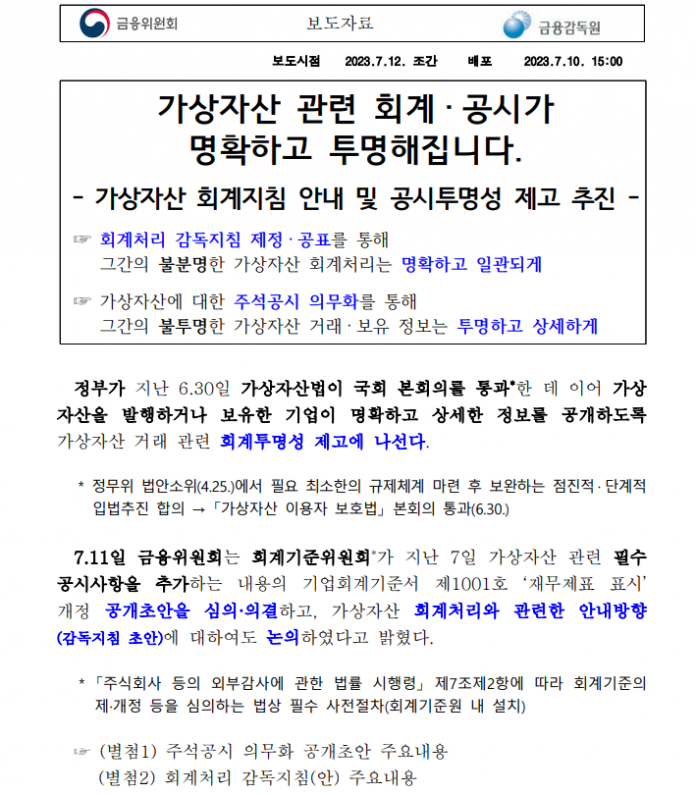

This is according to revised accounting standard rules announced by the Financial Services Commission (FSC), Korea’s top financial regulator, on Tuesday, aiming to raise transparency in accounting and public disclosures with regards to corporate ownership of cryptocurrency assets. The move follows the legislation of the country’s first law on the protection of cryptocurrency users, which was passed in a plenary session of the National Assembly at the end of last month.

“With the advent of blockchain-based technologies, transactions using digital assets have flourished and their impact on corporate accounting has also increased. Notwithstanding, there has been a lack of precise information on corporations’ cryptocurrency ownership available in financial statements,” the FSC said.

The top financial regulator added that while the International Financial Reporting Standards (IFRS) lag behind market changes in matters of accounting principles applied to cryptocurrencies, the passage of the first law on regulating and protecting digital assets has generated the need for new accounting rules that resolve uncertainties in local corporate financial statements.

The new accounting rules will require companies that have issued or held cryptocurrencies to specify detailed information on digital assets in the commentary section of their financial statements. So far, the white paper of a cryptocurrency issuance stated only partial information, lacking credibility.

With the changed obligatory rules taking effect next January, those who read the company’s financial statements will have access to more precise accounting information regarding cryptocurrencies issued or held. The digital asset information on fiscal year 2023 will be included as early as in the commentary section of companies’ quarterly financial statements published next year.

“With the revision, corporations’ accounting on digital assets will be more clarified and commentary on financial statements will be strengthened,” an official from the FSC said. “This will provide readers of corporate financial statements with more credible and reliable information. It is also expected that disagreements between companies and external auditors will decrease, with a lesser amount of uncertainty in accounting.”

As of the end of last year, five listed companies ― Kakao, WeMade, Netmarble, Neowiz Holdings and Danal ― issued some 10 different cryptocurrencies, while about 30 listed corporations are deemed to hold cryptocurrency assets, according to their annual reports. The total market value of cryptocurrency assets issued by third parties and held by listed companies stands at approximately 201 billion won ($155 million).

Download :

- (Press Release) How to Improve Transparency in Accounting and Disclosure of Virtual Assets

230710 (보도자료) 가상자산 회계공시 투명성 제고방안 FNFNFN - (Attachment 1) Draft Guideline on Mandatory Annotation Disclosure

230710 (별첨1) 주석공시 의무화 공개초안 주요내용 - (Appendix 2) Guidelines for Supervision of Accounting for Virtual Assets

230710 (별첨2) 가상자산 회계처리 감독지침 주요내용

Anna J.Park

(2023.07.12) “Financial Authorities Revise Accounting Rules for Crypto Assets to Raise Transparency”

retrieved from https://www.koreatimes.co.kr/www/nation/2023/07/602_354718.html