Financial authorities have initiated an investigation into allegations of price manipulation concerning the cryptocurrency AVAIL on the Bithumb exchange, which occurred on July 23-24. This marks the first investigation since the implementation of the Virtual Asset User Protection Act, which came into effect on July 19.

The Virtual Asset User Protection Act, enacted on July 19, prohibits unfair trading practices such as price manipulation, imposing criminal penalties or fines for violations. The AVAIL incident is the first case being investigated under this new law.

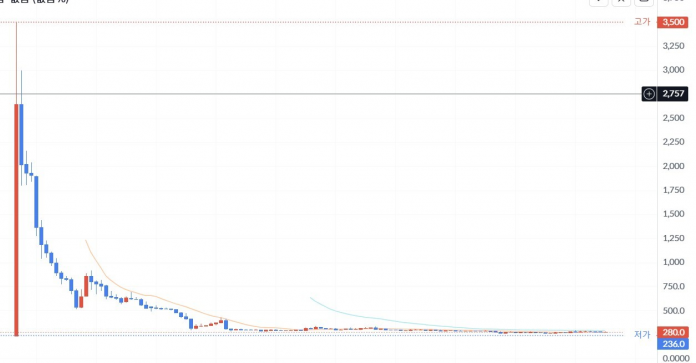

The Financial Supervisory Service’s (FSS) Virtual Asset Investigation Bureau is examining the sharp fluctuations in AVAIL’s price on Bithumb. On July 23, AVAIL’s price surged from 236 KRW to 3,500 KRW within 15 minutes, only to plummet to 284 KRW by 7 PM the next day. During this time, AVAIL was trading at around 210 KRW on other exchanges.

Investor A, identified as the key figure in this suspected price manipulation, held 1.17 million AVAIL tokens, accounting for 75% of Bithumb’s circulating supply, during the price surge. A allegedly gathered a large amount of AVAIL from foreign investors and led the trading on Bithumb, raising suspicions of price manipulation.

A commenced a fundraising campaign for AVAIL through his social media account, collecting approximately 4.2 billion KRW worth of AVAIL. He reportedly purchased AVAIL at a low price from foreign investors and sold it at a higher price in Korea, making a profit before buying back the tokens after the price crash to return a larger quantity to the original investors.

This incident also raises questions about the effectiveness of Bithumb’s abnormal transaction monitoring system. According to the Virtual Asset User Protection Act, exchanges must constantly monitor for unusual transactions and report any suspicious activity to financial authorities. However, there are concerns about whether exchanges can respond swiftly to sudden, short-term anomalies like the AVAIL case.

Financial authorities are investigating the possibility of A’s actions constituting planned price manipulation. Once the investigation is concluded, the case will be referred to prosecutorial agencies if any wrongdoing is found. The cryptocurrency industry is calling for a reassessment of the effectiveness of the Virtual Asset User Protection Act and the monitoring capabilities of exchanges in light of this incident.

Bithumb stated, “We conduct 24-hour monitoring of abnormal transactions and have properly monitored and reviewed the case in question.” Despite this, doubts about Bithumb’s ability to effectively monitor abnormal transactions persist following this incident.