The Federation of Banks has released guidelines for risk assessment of cryptocurrency exchanges. Earlier, in April, the Federation of Banks distributed to commercial banks the “Virtual Asset Businesses Money Laundering Risk Assessment Plan” so that banks could use them as reference materials when preparing standards for identifying, analyzing, and evaluating money laundering risks related to virtual asset businesses.

“The evaluation method is a reference material that banks can use voluntarily, and it is not recommended or enforced,” he added.

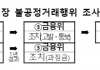

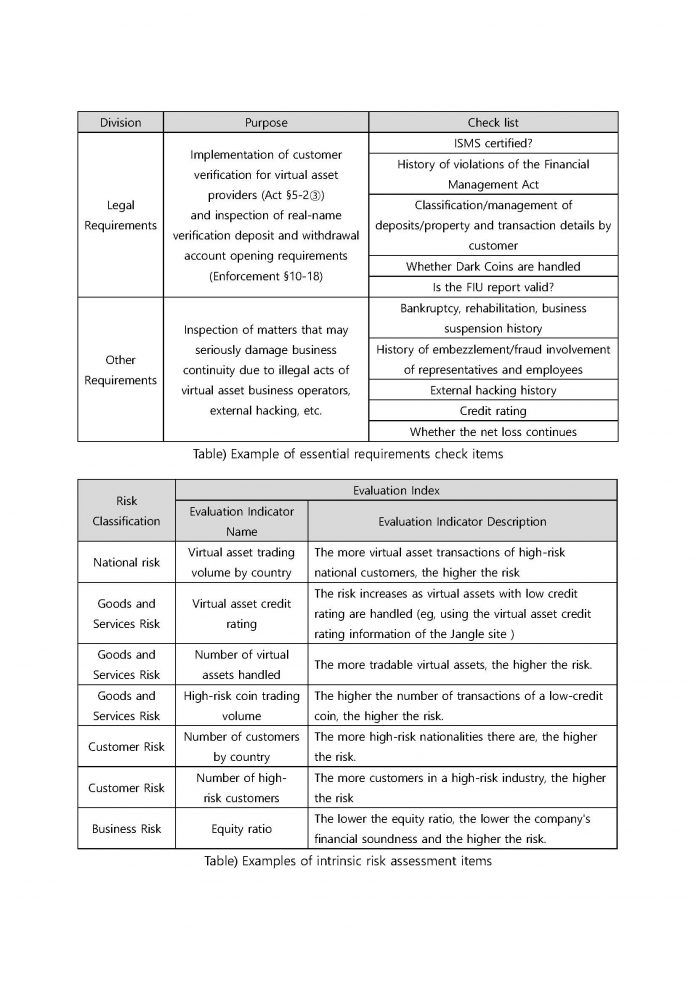

The evaluation plan classifies the money laundering risk assessment tasks of banks for virtual asset business operators as follows.

❶ Inspection of essential requirements ❷ Inherent risk assessment ❸ Control risk assessment ❹ Calculation of risk grade ❺ Deciding whether to trade

In addition, various evaluation indicators and evaluation methods that can be referenced at each stage are provided as examples.

Some banks are conducting due diligence on cryptocurrency exchanges based on the exchange risk assessment guidelines distributed by the Federation of Banks. In accordance with the amendment of the Special Financial Transaction Information Act, cryptocurrency exchanges must complete the business registration with the Financial Intelligence Unit (FIU) by September 24. For reporting, information security management system (ISMS) certification, real-name bank account acquisition, and anti-money laundering (AML) system must be secured. Currently, only four exchanges have received real-name bank accounts: Upbit, Bithumb, Coinone, and Korbit.

Download here Guideline for Crypto Exchange_EN