□ The definition, purpose and features of DCEP

ㅇ(Definition) The name for digital fiat currency in China is DCEP(Digital Currency Electronic Payment), not CBDC. DC means digital currency and EP(Electronic Payment) means electronic payment method.

ㅇ (Purpose) The purpose of DCEP is to replace the monetary base(M0). In other words, if the demand for cash reduces due to the use of DCEP, the amount of cash issuance and cash circulation will decrease. Therefore, it is expected that the cost for issuance and distribution of currency will decrease.

– In addition, concerns about personal data spill are accelerating the issuance of DCEP. Currently, China’s major mobile payment platforms, Alipay and WeChat Pay, have become popular, but these are the third-party electronic payment methods linked to bank accounts. Since the mobile payment platforms are linked to the accounts of traditional banks, personal data is required to use them. As a result, there have been cases of personal data spill. However, DCEP has the advantage of being safer than mobile payment system from the data spill in that it does not require a bank account and linked to the user’s electronic wallet through blockchain technology.(Individual e-wallets replace traditional accounts)

ㅇ (Features) It has same functions as the cash. It is a fiat currency issued by the central bank, and both individual and institutional bodies in China cannot refuse to use DCEP as a payment method.

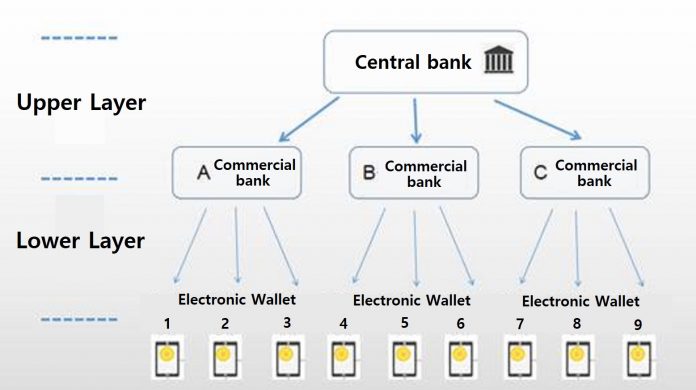

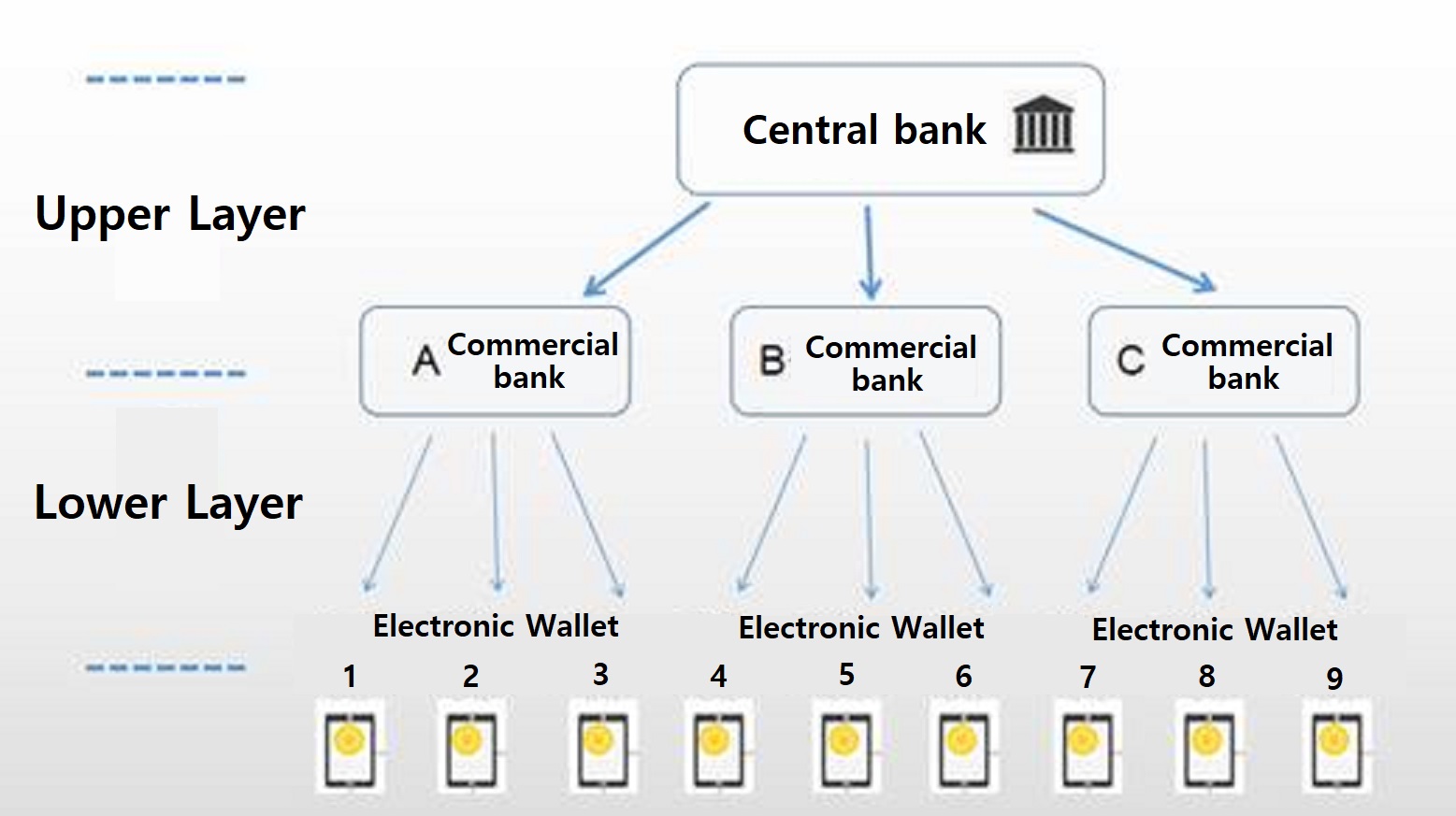

– It is issued in a double-layered. In other words, the central bank does not directly issue DCEP to the public, but the central bank issues DCEP to commercial banks and commercial banks deliver it to the public. In addition, since DCEP replaces the monetary base (M0), each commercial bank deposits 100% of reserve funds in the central bank and supplies DCEP to the public.

– You can trade it without the Internet. NFC and Bluetooth can be used to automatically transfer and pay between nearby smartphones.

– The Chinese government has announced that it will issue DCEP to establish sovereignty over the currency and improve credit and financial management. Thus it can track the flow of funds without a bank account. It is easy to track the trade history through the digital currency, so it can prevent illegal fund transactions.

Double-Layered Operating System of DCEP-Picture

Source: Korea Business Center in Guangzhou, China of KOTRA

Note: In the single-layered operating system, the currency issued by the central bank is delivered to the public. Under the double-layered operating system, a commercial bank acts as a mediator between the central bank and the public. Under this system, the central bank issues DCEP to commercial banks and commercial banks supply it to the public.

□ Implications

ㅇ China’s DCEP is expected to be launched in the first half of 2020 and the Chinese government will try to enhance the status of the yuan as a global payment method.

– According to the US online economic journal Business Insider, Facebook’s Libra will not be launced in 2020, while China’s DCEP is expected to be issued successfully.

– With DCEP, dependence on accounts will be decreased, and time and money for transfer in international payments will be significantly reduced. The convenience of DCEP could be very helpful to the internationalization of the yuan.

ㅇ China accounts for a large portion of Korea’s foreign trade. Korea should expect the rate of payment using DCEP to increase gradually and needs to be prepared for this.

– It is expected that inconvenience (such as taking a lot of time and fees) will be greatly reduced in payment transfer through DCEP. However, in the process of converting the payment to KRW after receiving it, another inconvenience may occur due to discordance of system between the bank in Korea and DCEP.

– Korea should thoroughly analyze the characteristics of DCEP and establish a system for Korean companies to deal with Chinese companies through DCEP easily, quickly and safely. Since the use of digital currency will increase in the US, Europe, and Japan in the future, Korea can use DCEP as a role model to prepare for the side effects of digital currency trading in other countries.

ㅇ Global competition for sovereignty over the currency will become more intense. Monitoring is required

– The competition between the US dollar and the Chinese yuan can be fiercer. The Federal Reserve launched digital currency issuance to prevent the Chinese yuan from challenging the dollar hegemony. When DCEP is issued, the US is expected to issue digital currency as soon as possible, and Europe and Japan are expected to issue it competitively.

– As major countries such as the US and China seem to encourage the use of digital currency, Korea should prepare for the troubles between global digital currency and the financial system.

Kim Hak-bin (2020.04.10) 중국의 디지털 화폐 동향

retrieved from http://news.kotra.or.kr/user/globalBbs/kotranews/3/globalBbsDataView.do?setIdx=242&dataIdx=181105