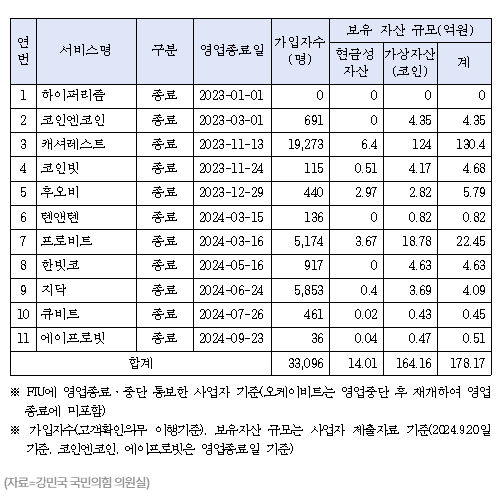

Investors are facing increasing losses as cryptocurrency exchanges that have either ceased operations or suspended services fail to refund their cash and digital assets. According to data received by Representative Kang Min-Kook from the Financial Services Commission (FSC) on September 22, as of September 2023, 11 cryptocurrency exchanges in South Korea have ceased operations, and 3 have suspended services. The total amount of unreturned cash and cryptocurrencies tied up in these exchanges amounts to ₩17.8 billion (approximately $13.3 million USD).

A total of 33,096 investors are awaiting refunds from the closed exchanges, with the largest number of affected users being from Cashierest (19,273 users), GDAC (5,853 users), and Probit (5,174 users). These closed exchanges are holding ₩1.4 billion in cash assets and ₩16.4 billion in cryptocurrencies, for a total of ₩17.8 billion. Cashierest alone is responsible for ₩13 billion in investor assets, including ₩640 million in cash and ₩12.4 billion in cryptocurrencies.

Despite the FSC having introduced guidelines for handling the cessation of operations by cryptocurrency businesses and conducting inspections to ensure the protection of user assets, a significant portion of these assets has yet to be returned. Representative Kang expressed concerns that more exchanges are likely to cease operations due to the growing burden of regulatory compliance costs amid a downturn in the cryptocurrency industry. He emphasized the need for tighter management of exchanges likely to close and urged the FSC to focus on preventing further investor losses.

Some exchanges, such as FlatTA, have repeatedly suspended cryptocurrency deposits and withdrawals under the pretext of “system maintenance,” exploiting a loophole in the Virtual Asset User Protection Act. Other exchanges like Bitrade and Oasis have also been blocking withdrawals for several months, further frustrating investors.

The lack of legal mechanisms to enforce asset refunds from closed exchanges has compounded the issue. There are no specific regulations for handling customer assets after an exchange ceases operations, allowing some exchanges to avoid the responsibility of returning assets if they remain inactive for several years. To address this, the FSC has established the Digital Asset Protection Foundation, which is responsible for overseeing asset refunds from closed exchanges. However, since there is no legal obligation for exchanges to transfer assets to the foundation, the initiative’s effectiveness remains uncertain.

Experts have noted that because cryptocurrency exchanges are not fully integrated into the formal financial system, investors are not protected in the same way as they would be with traditional deposits or savings accounts. This leaves investors more vulnerable, highlighting the need for increased caution when engaging in cryptocurrency investments.

![[November]Uptober No More](https://coinhubkorea.com/wp-content/uploads/2025/10/Whisk_d78880efb01a730907f4be201effefe1dr-1-324x235.jpeg)