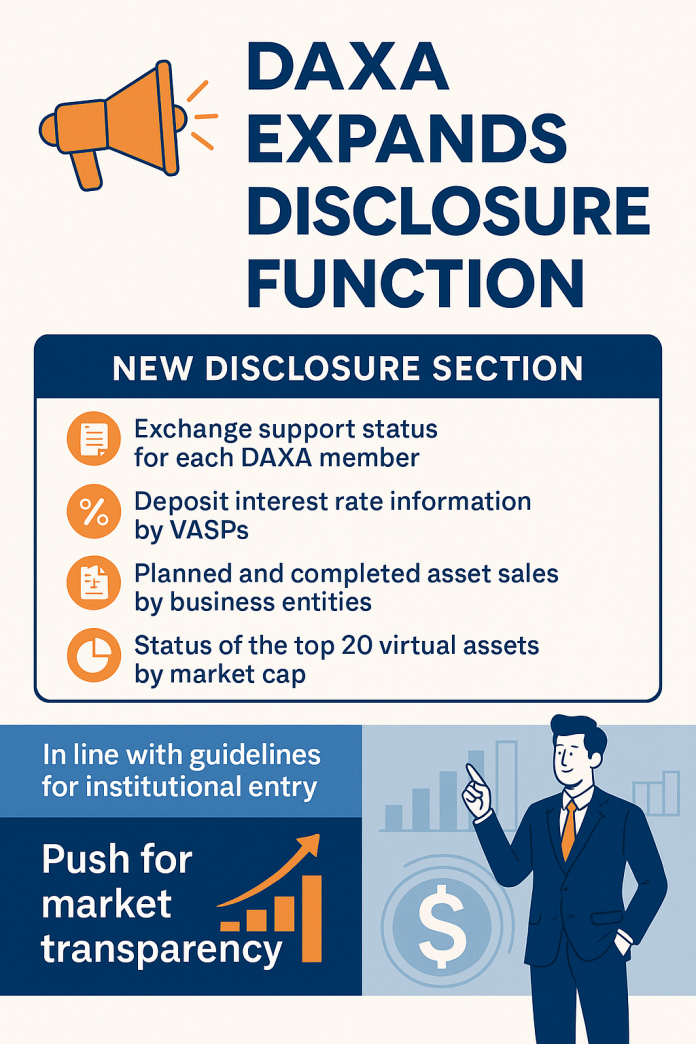

The Digital Asset eXchange Alliance (DAXA), a coalition of South Korea’s major crypto exchanges, has significantly expanded its disclosure system in an effort to enhance transparency in the virtual asset market. The move comes as part of the broader implementation of the Financial Services Commission’s (FSC) Phase 1 roadmap for institutional participation in digital asset markets.

DAXA has reorganized its official website by creating a newly structured “Disclosure” section, offering a broader set of publicly available data. The updated disclosures now include:

-

Exchange support status for each DAXA member,

-

Deposit interest rate information by virtual asset service providers (VASPs),

-

Business entities’ planned and completed asset sales,

-

Status of the top 20 virtual assets by market cap and their exchange listing details.

Of particular note is the inclusion of planned and actual asset sales by business entities. This will allow investors to more accurately interpret sudden price fluctuations and potential large sell-offs—an area previously lacking in transparency.

A DAXA spokesperson stated, “Providing reliable, timely, and standardized information is the first step toward a mature and trustworthy digital asset market. We plan to continuously expand the range of disclosures to institutionalize this framework.”

This system overhaul aligns with South Korea’s recent regulatory shift allowing institutional players—such as banks and securities firms—to enter the crypto market under new government guidelines. DAXA’s update is a proactive measure to prepare for institutional adoption and to ensure market participants have equal access to critical information.

Experts in the field have welcomed the move, noting that it could reduce information asymmetry and support a healthier, more stable investment environment for institutions. However, concerns remain regarding the lack of legal enforceability and standardization of the disclosures across platforms.

Ultimately, this expansion of DAXA’s disclosure function is seen not just as a technical upgrade, but as a milestone toward rebuilding trust and establishing a transparent, regulated digital asset ecosystem in South Korea.