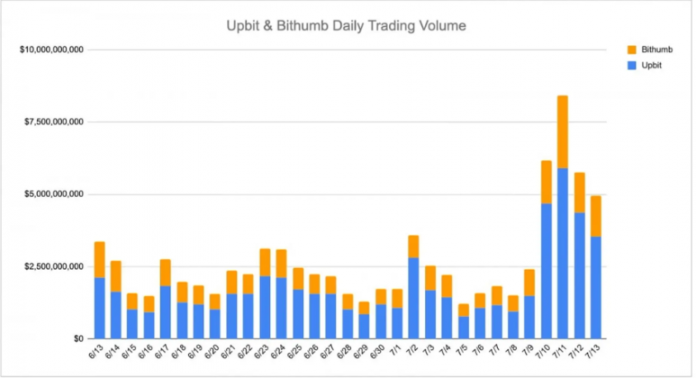

In the second week of July, the total daily trading volume on South Korea’s major cryptocurrency exchanges surged past ₩8 trillion, signaling renewed market activity. According to CoinGecko, the combined trading volume of the five key domestic exchanges—Upbit, Bithumb, Coinone, Korbit, and Gopax—reached $6.3 billion (₩8.78 trillion) on July 14, marking a 21.2% increase from the previous day and a 264% spike year-over-year.

This sharp rise followed Bitcoin’s all-time high breakout above $120,000 on July 11, which sent a wave of optimism through the market.

Notably, altcoin trading volume hit an all-time record, with Upbit contributing a significant portion—recording over $9 billion in daily trading on July 11. This indicates that investors are expanding their focus beyond Bitcoin to assets like Ethereum, XRP, Dogecoin, and Solana.

The surge in trading is also tied to broader financial and policy expectations. Growing anticipation of a U.S. Federal Reserve rate cut in September is boosting risk-on sentiment. Meanwhile, former President Donald Trump’s pro-crypto policy rhetoric—including congressional moves like recognizing a “crypto week”—has added fuel to bullish momentum.

Among exchanges, Upbit accounted for over 70% of the total trading volume, maintaining a dominant position, while Bithumb recorded a 341.5% year-on-year increase—showcasing a robust comeback.

Outlook & Implications

-

Entering a High-Volatility Phase

While Bitcoin’s breakout has revitalized the market, caution is advised as short-term corrections may follow. Future Fed policy decisions and macro risk factors could drive increased volatility. -

Altcoin Preference Remains Strong

Korean retail investors continue to favor altcoins over Bitcoin. With higher risk comes greater return potential, making altcoins likely to remain central to trading activity. -

Policy Momentum to Watch

Government moves in Korea and legislative activity in the U.S.—such as ETF approvals or stablecoin frameworks—could have a direct impact on market sentiment. Regulatory direction will play a key role in sustaining investor confidence.